The crypto trading process has always been fast; however, the current pace feels even sharper. Prices fluctuate within seconds, markets react instantly to news, and emotions often drive people to make hasty decisions. In today’s increasingly complex trading environment, many traders look for smarter ways to manage risk and improve timing. This is where artificial intelligence quietly steps in. Instead of guessing patterns by eye, traders explore systems that learn from data, identify trends, and react without panic.

At an early stage of learning, many newcomers explore the idea of using automated intelligence as part of their strategy. The objective is straightforward, even though the concept may seem technical. These systems analyze large volumes of market data and make logically based decisions rather than emotional ones. When traders understand how these tools work, they can decide whether this approach fits their personal style and goals.

What machine learning brings to crypto trading

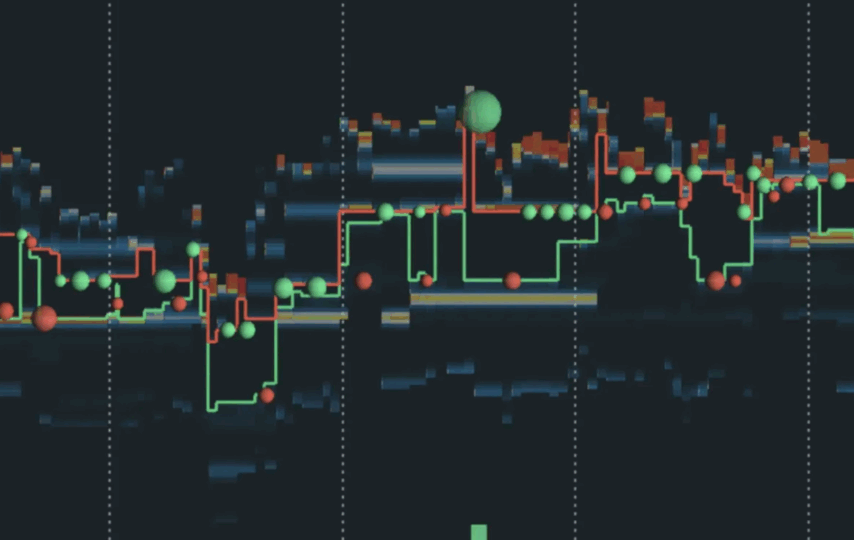

Machine learning is a way of making software learn and improve through practice. In trading, this means analyzing past price movements, changes in volume, and overall market behavior to identify trends. An AI crypto trading bot applies this learning process by gradually adjusting its logic based on what has worked and what has not over time. This results in a more adaptive and responsive approach compared to relying solely on static indicators.

Some core strengths of machine learning in trading include:

- Processing large data sets faster than humans.

- Identifying hidden patterns in price movements.

- Adjusting strategies as market conditions change.

- Reducing emotional decision-making.

These strengths make AI tools appealing in markets that never sleep.

How AI trading systems make decisions

AI-based systems follow models trained on historical and real-time data. They monitor price action, order flow, and sometimes social signals. When certain conditions match their learned patterns, they execute trades automatically. This removes hesitation and keeps actions consistent.

Typical data inputs include:

- Historical price charts

- Volume and liquidity metrics

- Volatility indicators

- Time-based market behavior

Each input helps shape a more informed trading response.

Benefits for both new and experienced traders

For beginners, AI tools can reduce the pressure of constant monitoring. For experienced traders, they offer speed and discipline. The key benefit is consistency. A machine does not chase losses or overtrade due to excitement.

Traders often value AI systems because they:

- Operate continuously without fatigue.

- Follow predefined risk rules.

- React faster to market changes.

- Allow traders to focus on strategy instead of stress.

This balance helps traders stay grounded during volatile periods.

Limitations and realistic expectations

AI is not a magic solution. Markets can behave unpredictably, especially during major news events. Poor data or weak models can still lead to losses. Traders must understand that AI supports decisions, not guarantees profits.

Common limitations include:

- Dependence on quality data.

- Difficulty handling sudden market shocks.

- Need for regular monitoring and adjustment.

- Risk of overconfidence in automation.

Smart traders treat AI as a tool, not a replacement for judgment.

Choosing an approach that fits your style

Not all traders want full automation. Some prefer semi-automated systems that provide signals instead of direct execution, while others are comfortable with full automation supported by strict limits. The right choice depends on a user’s comfort level, risk tolerance, and market knowledge.

As interest in automation continues to rise, more traders explore different platforms and setups that incorporate an AI crypto trading bot to support disciplined and data-driven trading decisions.

AI-based trading is reshaping how people interact with crypto markets by bringing structure, speed, and clarity to an otherwise unpredictable environment. When machine learning tools are used wisely, they can support better decision-making while reducing emotional pressure. The future of trading is not about removing humans from the process, but about empowering them with smarter tools that help navigate an ever-changing digital market with confidence and insight.