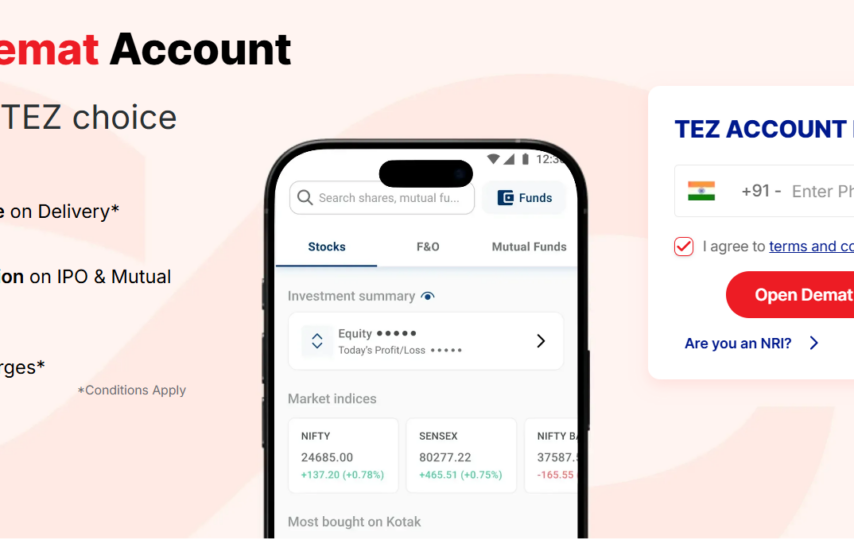

A Demat Account is the basic foundation for investing in the Indian financial markets. Simply put, a Demat (short for dematerialized) account is like a bank account, but instead of holding money, it holds your financial securities like stocks, bonds, ETFs, and other investments in an electronic form. By eliminating paperwork and reducing risks like loss or forgery, a Demat account makes investing safer, faster, and more efficient for both beginners and experienced investors.

Understanding Demat Account Charges is as important as convenience before you actually begin investing. Demat account charges are used for maintaining the account, processing transactions, and other services that might affect your overall investment returns. Since your Demat account is linked to a trading account and a bank account, transacting in securities becomes more convenient, and understanding the charges is an essential part of your investment process.

What Is a Demat Account and How It Works

A Demat account is an electronic repository where all your investments are stored in a digital form. It is managed by depository bodies such as the National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL), and administered through a Depository Participant (DP), usually a bank or a brokerage firm.

When you purchase shares using your trading account, they are automatically credited to your Demat account. Similarly, when you sell shares, debit happens through your Demat account, making it easier to have automatic settlements without the need to physically transfer security certificates, thus cutting down on paperwork and shortening the time frame for transactions.

Key Features of a Demat Account

A Demat account provides several benefits that make investing easier for you:

- Secure storage: Dematerialization of your securities safeguards against risks associated with physical storage, such as theft, loss, and forgery.

- Easy access: Simply log in to your Demat account from your computer, mobile, or tablet and track your investments at any time.

- Automatic crediting: Dividends, bonus shares, stock splits, rights issues, and interest earnings are automatically credited to your Demat account.

- Collateral for loans: The securities in your Demat account can often be used as collateral for securing loans from banks or other financial institutions.

- Easy portfolio management: All your stocks and other securities are stored in one virtual place, making it easy to track and manage them.

Understanding Demat Account Charges

If you already have a Demat account, you must be aware of the charges associated with its maintenance and usage. Demat Account Charges differ depending on your Depository Participant and type of Demat account, but the basic charges include:

1. Account Opening Charges

Most brokers do not charge any account opening charges, but some may still charge a small one-time fee.

2. Annual Maintenance Charges (AMC)

This is an annual charge that is required to keep your Demat account active. Under SEBI’s BSDA scheme, small investors are eligible for a reduced or zero AMC charge for specified balances.

3. Transaction Charges

These are charges that are levied every time you sell or transfer securities out of your Demat account. These charges are either a flat fee per transaction or a percentage of the transaction value.

4. Dematerialisation & Rematerialisation Charges

When you dematerialize your securities (i.e., convert physical securities to Demat form) or rematerialize your securities (i.e., convert Demat securities to physical form), you may have to pay a small fee.

5. Miscellaneous Charges

Postal charges, delivery instruction processing fees, and other administrative charges may be included in this category.

Understanding these Demat account charges before you open a Demat account will help you compare different Demat account providers and choose the one that suits your investing needs in the most cost-effective manner.

Demat Account Powering Your Investing Journey

A Demat account transforms the manner in which you interact with financial markets:

- It eliminates the tedious paperwork associated with traditional investments, reducing the scope for errors and consuming less of your precious time.

- It enables faster trading and settlement, allowing stocks to be credited or debited to your account sooner after a trade.

- With automated credits for dividends and other corporate benefits, it provides an effortless means to earn passive income.

- When combined with trading platforms and mobile applications, a Demat account enables real-time monitoring of your portfolio’s performance.

In essence, your Demat account is an online gateway between your financial objectives and the dynamic market possibilities.

FAQs

1. Is a Demat account mandatory for mutual fund investments?

A Demat account is not mandatory for direct mutual fund investments; however, holding units of mutual funds in a Demat account can help streamline your portfolio by allowing you to view all your investments in one place.

2. What if I don’t access my Demat account for a long time?

If a Demat account remains unused for an extended period or if AMC fees are not paid, the account may become dormant or inactive, which may attract reactivation charges as per your DP’s rules.

3. Can I transfer my Demat account to another broker?

Yes. When you change brokers, you can transfer your existing Demat holdings to a new Depository Participant without opening a new account.