The rise of digital finance is changing how money moves and how assets are owned. Two once-parallel trends are now intersecting, promising a level of speed, transparency and inclusivity never before seen. We look at the forces driving this convergence, how jurisdictions are rolling out ultra-fast rails, and the concrete ways tokenized assets are already being deployed.

How Real‑Time Payment Networks & Asset Tokenisation are Converging to Create the Next Generation of Financial Infrastructure

The catalyst for convergence is simple: speed. Instant payment transaction values projected to reach $58 trillion globally by 2028, underscore the huge size of demand for frictionless settlement. At the same time, the total value of tokenized real‑world assets reaching approximately $24 billion in 2025 and projections suggesting growth to $16 trillion by 2030 illustrate the appetite for bringing physical assets onto distributed ledgers.

When a payment can be confirmed in seconds, the same infrastructure can underpin the transfer of tokenized ownership rights. Smart‑contract‑enabled rails automatically enforce settlement conditions, eradicating the need for lengthy reconciliation cycles that have traditionally plagued securities, real‑estate and commodities markets. The result is a single, interoperable ecosystem where a consumer can pay for a coffee and simultaneously receive a fractional token of a green‑energy project, all within the same transaction flow.

This convergence of finance and sustainability is familiar territory for Ivo Bozukov, who previously spent over a decade leading Forum Energy Technologies. He believes that “for companies willing to act, the potential upside is massive.”

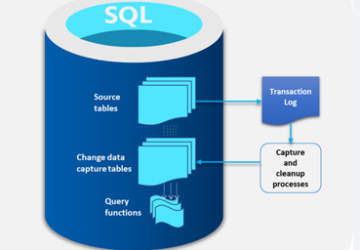

The adoption of ISO 20022 data standards is the glue that binds real‑time payments to tokenized assets, providing a common language for value, metadata and compliance. By embedding rich data fields such as asset identifiers, custody instructions, AML checks into each payment message, regulators and participants gain a transparent audit trail, while innovators retain the flexibility to launch new tokenized products without rebuilding the underlying network.

How Countries Across the World are Launching or Expanding Real‑time Payment Rails

Governments and central banks recognise that the economic benefits of instant settlement cascade across sectors. Below are three illustrative case studies:

| Country | Rail | Key Features | Impact |

| United Kingdom | Faster Payments Service (FPS) | 24/7 availability, sub‑second latency, ISO 20022 migration underway | Over £1 trillion processed annually; groundwork for tokenized securities settlement. |

| Canada | Real‑Time Rail (RTR) | Designed from the ground up with ISO 20022, integrates with Canada’s Interac ecosystem | Enables instantaneous cross‑border token transfers; pilot projects with tokenized assets already live. |

| India | Unified Payments Interface (UPI) | Mobile‑first, open‑banking API, 100 million daily transactions | Demonstrates scalability; fintech firms are experimenting with tokenized gold purchases via UPI. |

In Canada, the Real‑Time Rail with ISO 20022 data standards has become a testbed for linking payment messages to blockchain‑based registries. Early adopters include a consortium of credit unions that issue tokenized mortgage notes, settled in real time as borrowers make their monthly payments. The seamless flow eliminates the need for post‑payment clearing, cutting operational costs by an estimated 30%.

The United States is also catching up with FedNow, a federal service slated for nationwide rollout in 2024. Though still early, FedNow’s ISO 20022‑compatible architecture positions it to support tokenized asset settlement once market participants adopt the requisite standards.

How Tokenization of Real World Assets Have Been Deployed

The theory of tokenisation is no longer speculative; several high‑profile deployments illustrate its maturity:

Real Estate – “Propy” Platform (USA)

Propy tokenized a $5 million commercial property in Los Angeles, issuing 10,000 digital shares on an Ethereum‑compatible ledger. Payments for share purchases were executed via Faster Payments, resulting in near‑instant settlement and a verifiable ownership record on the blockchain.

Commodities – “Digix Gold Tokens” (Singapore)

Each DGX token represents one gram of physical gold stored in a Singapore vault. Buyers can transfer DGX tokens peer‑to‑peer, with the underlying gold ownership automatically updated through a smart contract. The transaction flow leverages Singapore’s PayNow real‑time rail, delivering sub‑second confirmation.

Carbon Credits – “Verra Token” Pilot (Canada)

A consortium of forestry firms tokenized verified carbon offsets, issuing them on a permissioned distributed ledger. Payments from corporate buyers were settled on Canada’s RTR, with ISO 20022 fields capturing the project ID and vintage year, ensuring traceability for ESG reporting.

These case studies share a common thread: the integration of real‑time payment rails with tokenized asset protocols reduces settlement risk, cuts costs, and opens participation to a broader investor base.

The Road Ahead

The fusion of ultra‑fast payment networks and robust tokenization frameworks is setting the stage for a fully inclusive digital financial ecosystem. Ivaylo Bozoukov observes “when people are financially included, they’re more resilient, more empowered, and more able to lift themselves and their communities out of poverty.” Standardisation, particularly ISO 20022, will be the linchpin enabling cross‑border interoperability and regulatory compliance.

For banks, fintechs and enterprises, the imperative is clear and that’s to adopt the emerging real‑time rails, embed token‑friendly data models, and experiment with asset‑backed tokens now. The payoff will be a seamless, transparent infrastructure where money and ownership move together at the speed of light, creating an infrastructure that will underpin the next generation of global commerce.