MEXQuick is a next-generation Web3 platform designed to support derivatives trading and AI-driven market-making within a structured, transparent, and system-oriented framework. Rather than positioning itself as a traditional exchange, MEXQuick operates as an integrated trading infrastructure where short-term trading, automated liquidity, token economics, and user participation converge.

Time of Establishment

According to MEXQuick, it was founded in 2024. MEXQuick began its development with a deliberate focus on infrastructure rather than visibility. The initial phase centered on assembling a market-experienced team and designing core systems, including contract logic, pricing mechanisms, and liquidity behavior models. Throughout 2024 and into early 2025, the platform remained in internal testing to ensure that trading, liquidity, and token mechanics could operate as a unified system under real-market conditions.

From January to May 2025, MEXQuick entered a controlled early-access phase, onboarding experienced users through partnerships with professional trading communities to validate performance and usability. Momentum increased in mid-2025 with the launch of the Mystery Box Event in July, followed by participation in the Bali Blockchain Expo in August to support regional outreach. The platform reached a key milestone on September 17, 2025, with the launch of Ticket Contracts and major system upgrades, marking MEXQuick’s transition from an early-stage concept into a fully integrated, AI-supported Web3 trading infrastructure operating within an increasingly defined regulatory environment.

How MEXQuick is Built

The platform’s design reflects structural changes in crypto markets, where derivatives and liquidity systems increasingly function as core layers rather than auxiliary tools. MEXQuick was built to address this shift by focusing on system efficiency, risk clarity, and sustainable liquidity rather than speculative incentives.

Key Products and System Design

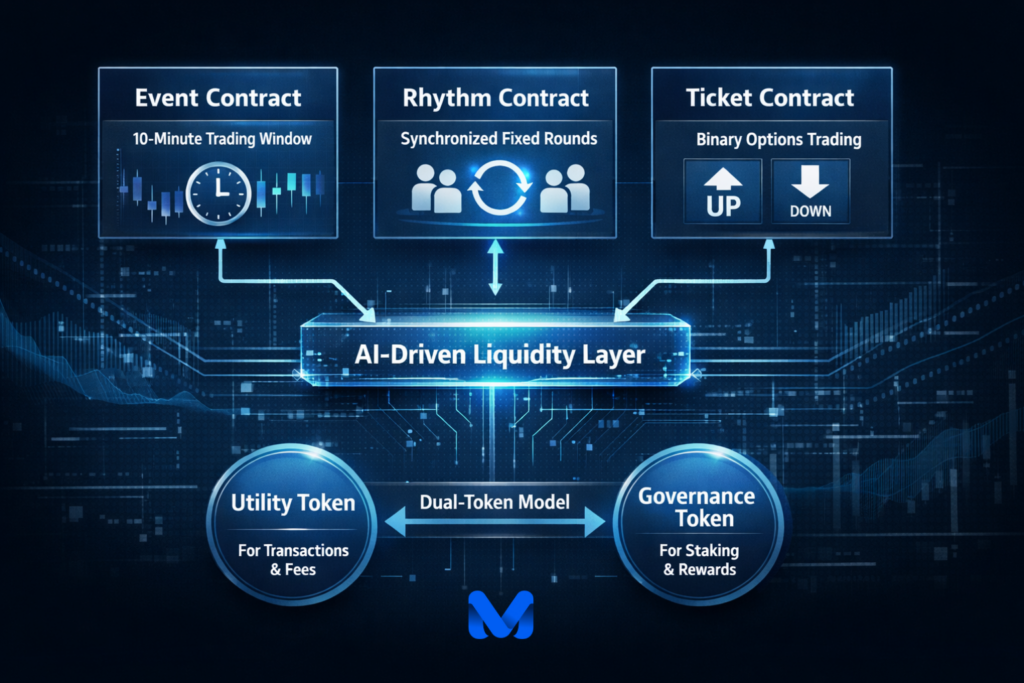

MEXQuick’s product architecture is organized around derivatives trading models that emphasize clarity of risk and timing. The platform offers multiple contract structures, each designed to address different trading behaviors while maintaining defined parameters. These products are supported by an AI-driven liquidity layer that continuously adjusts order depth and pricing responsiveness based on system conditions such as;

- Event Contract → It is a short-term, highly leveraged trading product that allows users to speculate on the price movements within a fixed 10-minute period.

- Rhythm Contract → It use a fixed-round trading mechanism, with all users opening and settling positions uniformly, eliminating unfair advantages caused by latency.

- Ticket Contract → It is a short-term price prediction product based on a binary options mechanism

Rather than relying on manual market-maker intervention, MEXQuick integrates algorithmic liquidity management as a foundational component of the platform. This approach is intended to improve consistency and reduce reliance on external liquidity providers.

The platform’s dual-token model further separates operational utility from participation incentives, helping maintain balance between usage, governance mechanisms, and system sustainability.

Regulation and Compliance

According to the European Commission (2023), As standards matured, MEXQuick adopted a compliance-aware approach that emphasizes transparency, traceability, and risk disclosure to align with evolving global regulatory expectations for digital asset and derivatives platforms. Compliance considerations are integrated at the architectural level rather than treated as external constraints.

MEXQuick are registered under multiple layered of entity :

MEXQuick operates under a multi-layered structure that separates governance, operations, and compliance to support regulatory clarity and accountability.

- Governance Layer under MEXQuick Research Foundation, responsible for strategic oversight, policy alignment, and structural governance

- Operational Layer under MEXQuick INC, which manages defined system and platform operations

- Federal Layer through Money Services Business (MSB) registration, aligning applicable activities with U.S. federal compliance requirements

Legal and Compliance

MEXQuick does not position itself as a regulatory authority, nor does it claim exemption from applicable laws. Instead, it maintains a compliance-aware posture aligned with responsible platform operation in a changing regulatory environment.

| Entity Layer | Entity Name | Registration / ID | Key Details | Official Verification Authority |

| Governance Layer | MEXQuick Research Foundation | Entity ID: 20251654345Name Amendment Filing No.: 20258194030 | Oversight and governance structure | Colorado Secretary of State |

| Operational Layer | MEXQuick INC | Registration No.: 2025-001802260EIN: 39-5141157Entity Type: Profit Corporation | Core operational and business execution entity | Wyoming Secretary of State |

| Federal Compliance Layer | U.S. FinCEN MSB | MSB Registration No.: 31000314492672Registered Entity: MEXQuick INCFiling Type: Corrected Report / Re-registration | Federal money services business registration | U.S. FinCEN |

Mission and Vision

As derivatives markets grow more complex, MEXQuick’s purpose is grounded in lowering participation barriers while ensuring that efficiency, fairness, and shared value remain central to its growth. The following mission and vision outline how the platform intends to balance innovation with inclusivity in the evolving derivatives landscape.

Mission :

“To make it easy for anyone to join the derivatives market, share real liquidity profits, and promote smart and inclusive finance”.

MEXQuick’s mission is to build a fairer and more efficient trading environment by aligning market-making mechanisms, product design, and user participation within a transparent system.

Vision :

“To become the world’s leading short-term derivatives and social finance platform, using AI technology to improve efficiency and fairness in the market”.

Its long-term vision centers on making advanced trading infrastructure more accessible without lowering risk standards or relying on opaque pricing mechanisms. This includes reducing information asymmetry, improving liquidity consistency, and ensuring that platform mechanics remain understandable and auditable by users.

Core Goal and Platform Scope

The core goal of MEXQuick is to provide a sustainable derivatives trading environment supported by intelligent liquidity systems.

Within this scope, the platform focuses on:

- Short-term derivatives products with predefined structures

- AI-assisted market-making designed to stabilize liquidity rather than amplify volatility

- A dual-token economic model that separates transactional utility from participation incentives

- Social and community-based mechanisms that encourage responsible engagement

MEXQuick does not position itself as a generalized financial marketplace. Its scope is intentionally limited to derivatives-focused trading systems and the infrastructure required to support them efficiently.

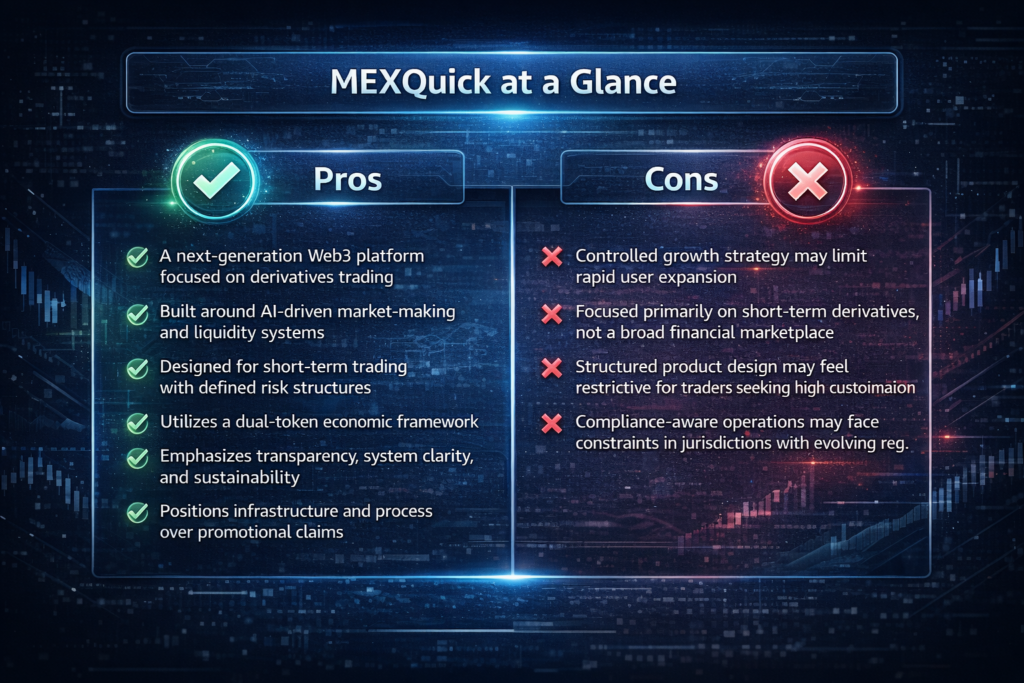

MEXQuick at a Glance

As short-cycle derivatives continue to gain traction, market participants are increasingly prioritizing clarity, risk definition, and structural resilience over rapid feature expansion or aggressive promotion. MEXQuick enters this environment with a deliberately system-first approach, emphasizing transparent mechanics, disciplined product design, and compliance-aware operations. The following assessment outlines the platform’s key advantages and constraints, offering a balanced view of how MEXQuick positions itself within an increasingly mature and scrutinized Web3 derivatives landscape.

Pros

- A next-generation Web3 platform focused on derivatives trading

- Built around AI-driven market-making and liquidity systems

- Designed for short-term trading with defined risk structures

- Utilizes a dual-token economic framework

- Emphasizes transparency, system clarity, and sustainability

- Positions infrastructure and process over promotional claims

Cons

- Controlled growth strategy may limit rapid user expansion

- Focused primarily on short-term derivatives, not a broad financial marketplace

- Structured product design may feel restrictive for traders seeking high customization

- Compliance-aware operations may face constraints in jurisdictions with evolving regulations

Conclusion

MEXQuick represents a measured response to the maturation of digital asset markets, prioritizing system integrity, transparency, and regulatory awareness over speculative growth. By combining structured derivatives products, AI-supported liquidity, and a clearly defined governance and compliance framework, the platform positions itself as durable infrastructure rather than a short-term trading venue. While its narrow scope and disciplined expansion may not appeal to all market participants, these same characteristics support its long-term objective of building a sustainable, auditable, and institution-ready derivatives trading environment.