When facing a cash shortage, quick access to funds becomes crucial. In such situations, borrowing money through a hassle-free process that provides same-day availability can be a relief. Online payday loans are a viable option in such cases. This is because they do not require a credit check and have no impact on your credit score.

While they do charge high-interest rates, their short repayment periods help mitigate the financial burden when used sparingly. However, it is important to exercise caution and choose a reputable lender, and this review highlights some trustworthy options. Read the article about $255 Payday Loans Online Same Day.

$255 Payday Loans Online Same Day

These services are not direct lenders but rather aid in finding a suitable lender for you. They can quickly prequalify your loan request and provide you with multiple loan options within minutes. Once you finalize the loan agreement, they will transfer the funds to your bank account promptly. Some lenders even offer same-day deposits.

In some cases, you may have the option to expedite the deposit by paying an additional fee.

1. MoneyMutual

Our top-rated lending network is MoneyMutual, which provides numerous loan options with no minimum credit score requirements. It takes just a few minutes to request a loan. And you can expect to receive a credit decision, potentially including a payday loan offer, shortly after.

MoneyMutual has lenders who are willing to work with borrowers with various credit difficulties. Additionally, there are no strict requirements except having a minimum monthly income of $800 to be eligible for a loan.

2. BillsHappen®

By completing the fast payday loan application process offered by BillsHappen®, you can find out if a direct lender is willing to work with you. Submitting the form to determine if you prequalify will not have any impact on your credit history or score.

To become eligible for a loan, you will need to provide information about yourself. This also includes your income, your employer, and the frequency of your paychecks. If successful, you will have the opportunity to review the loan terms, accept the offer, and swiftly receive your funds.

3. CreditLoan.com

CreditLoan.com specializes in assisting individuals with poor credit in obtaining online payday loans starting at $250. With over 750,000 customers served since 1998, they have a wealth of experience in facilitating online loans.

CreditLoan’s primary focus is on assisting those with bad credit. And if approved for a loan, you are free to use the funds for any purpose without affecting your credit history or score.

4. SmartAdvances.com

At SmartAdvances.com, you can be matched with a payday loan without the need for credit checks. Instead, your income will be the primary factor in determining loan approval. Lenders will verify that you can repay the loan on time. And automatic repayment will act through your bank account.

Although these loans may be straightforward to obtain, SmartAdvances cannot guarantee final loan approval. Furthermore, the website may offer personalized financial services. These include credit repair or debt relief, to better suit your specific needs.

Also Visit: 5G Changing the Game for Online Casino Industry

5. CashAdvance.com

If you need quick cash loans ranging from $100 to $1,000, CashAdvance.com can assist you. You can receive fast approvals without undergoing credit checks, and it will not affect your credit score.

To be eligible, you must have a monthly income of at least $1,000. Additionally, you need to have been employed for 90 or more days. CashAdvance.com offers customer support via email or phone to help guide borrowers through each step of the lending process.

Meaning of Online Payday Loan

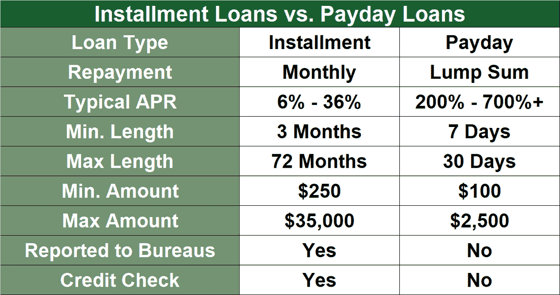

A payday loan is a small, unsecured personal loan that you have to repay on your next payday. This is usually within one to four weeks. These loans provide emergency cash when you need it most, and you should not view it as a regular supplement to your income due to their high interest rates.

Unlike auto title loans, payday loans are not secured by the property. Instead, your next paycheck backs the loan. Generally, online payday lenders will collect electronic repayments directly from the borrower’s bank account.

If you need a payday loan, you can easily apply online through a matching service that works with a network of direct lenders. Simply fill out a short loan request form on any of the reputable websites. It will help you to pre-qualify your $255 payday loans online same day easily. If you meet the lender’s requirements, you will meet a direct lender to complete the payday loan application process.

Other Important Details

It’s important to note that the reviewed loan-matching services do not charge fees, and you are not obligated to accept a loan offer. If a direct lender approves your loan and you electronically sign the loan agreement, the funds will typically be deposited into your bank account as soon as the same day, but more likely on the next business day.

When taking out a payday loan, you are required to repay the loan amount in full on your next payday. These loans often have high-interest rates that can range from 300% to over 700%. Due to the short loan period, it can be challenging to repay the loan amount in time, which can further increase the cost.

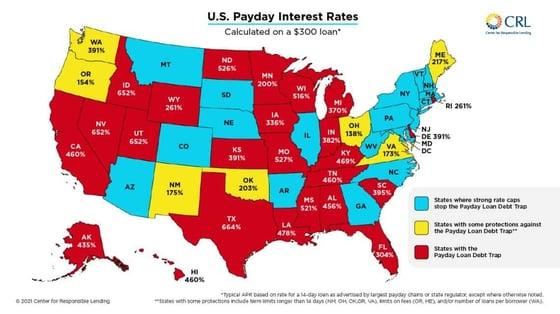

Despite the high costs, payday loans can be useful in emergencies, especially for those with poor or limited credit history. The primary requirement for getting a payday loan is having a documented source of income. To prevent predatory lending, some states have implemented regulations that control the availability and cost of payday loans. These laws can prohibit or limit the use of payday loans and set a cap on interest rates.

Do People Need to Have a Credit Score to Get a Payday Loan?

To qualify for a payday loan, a credit score is not necessary. The primary requirement is a stable source of income from employment, government benefits, alimony, annuities, or any other credible sources. As payday lenders do not perform credit checks or report payments to credit bureaus, these loans cannot help establish or rebuild credit.

However, if you fail to repay the loan on time and the delinquent amount remains unpaid for over a month, the lender may notify major credit bureaus, causing significant harm to your credit scores.

Moreover, if the unpaid account is turned over to a collection agency or the lender files a lawsuit to recover the outstanding debt, it can severely damage your credit score and may even result in bankruptcy.

The Amount You Have to Pay For a $255 Payday Loan

When taking out a payday loan of $255, the overall cost will depend on the APR, which can range from 200% to 700%, as well as the loan term, which typically lasts between one to four weeks. For instance, a 14-day payday loan with a 300% APR will have a loan financing fee of $29.35, while the cost increases to $68.47 for a 700% APR.

Failing to repay your loan on time can lead to significant cost increases. If you cannot pay, the payday lender may roll over your loan, which adds the previous financial fee to the loan principal and tacks on a new, larger fee, while resetting the repayment date to your next pay date. Continued failure to pay can lead to substantial debt, potentially reaching thousands of dollars.

How Safe Are $255 Payday Loans Online Same Day?

While there are some disreputable payday loan lenders out there, the reviewed lending networks have proven themselves to be trustworthy and dependable. However, it is essential to ensure that any lender you consider for a payday loan has a valid license to operate in your state or county.

You can check with your state’s Secretary of State or Attorney General to see if there are any enforcement actions against the lender. Also, it’s a good idea to visit the Consumer Financial Protection Bureau’s website to learn more about the protections available to you as a payday loan borrower.

Also Visit: How to Change APN Settings for Unlimited Data on Android & iPhone