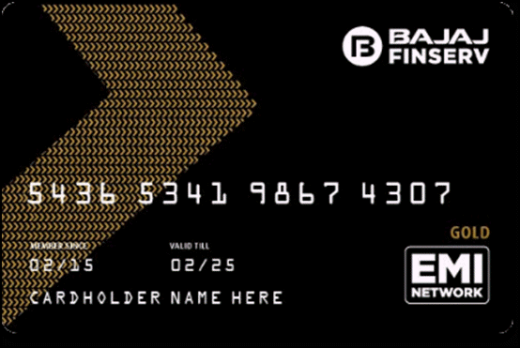

The Bajaj Finserv EMI Network Card is your digital equivalent of the physical debit or credit card that you have. However, this digital card is a shopping whizz, helping you get the best deals in the market. Apply for EMI card online so that you can access all the perks and privileges on offer. Just log on to the website, fill in a few simple details, complete the KYC verification process, and you are as good as done! Whether you want new apparel for an occasion or an appliance to reduce the load of household chores, the Bajaj Finserv EMI Network Card covers all purchases. You can keep track of all your expenses through the Bajaj Finserv Wallet app or the Experia website so that you are always in control. Shop online on the Bajaj Finserv EMI Store or at any of the 1.2 lakh+ Bajaj Finserv partner stores across 2,900+ cities to make the best use of the card.

Features of the Bajaj Finserv EMI Network Card

The benefits of the Bajaj Finserv EMI Network Card are many, but these are the three benefits that you should know about.

· Pre-approved Loan: If you are aware of digital finance, you must have heard about pre-approved loans. However, you can get a pre-approved loan of as much as Rs. 4 lakhs on the Bajaj Finserv EMI Network Card. Apply for Bajaj EMI card to avail of this privilege. Thereafter, you can use the card for any kind of shopping and do not have to hesitate before making a big-ticket purchase. Furthermore, you can repay this amount without any added interest by availing of the No Cost EMI feature. The pre-approved loan also saves the time and energy that you would otherwise spend in getting a loan application sanctioned.

· Flexible Repayment Period: The Bajaj Finserv EMI Network Card allows you to choose repayment tenor of your convenience. So, you are at liberty to choose a stretched out scheme, because there is no interest to be paid anyway. On the other hand, if you want to settle your account on an earlier date, you can do so without paying any penalty. Foreclosure should not attract penalties, and the card is flexible in that respect.

· Minimum Documentation: Bajaj Finserv will not ask you for a ton of documents before approving your application. You need to produce the bare minimum of address proof, proof of your financial status and proof of age. All these requirements can be easily satisfied with the help of your Aadhaar Card, PAN Card or your Voter ID card. To apply for EMI card, you must not be below 21 and above 60 years of age. Once this documentation is taken care of, you will not be asked for any proof henceforth. Make your purchases with full confidence once you have obtained the EMI Network Card.

Miscellaneous Benefits of the Bajaj Finserv EMI Network Card

Apart from access to pre-approved loans, financial flexibility and lack of a stringent documentation policy, there are many other reasons why you should apply for EMI card. Let us look at a few such reasons:

· Great Range: You can buy anything and everything either on the Bajaj Finserv EMI Store or at the Bajaj Finserv partner stores like Croma or Reliance Digital. There are lakhs of products from the best brands to choose from. Additionally, you can even use the EMI Network Card on e-commerce partner sites such as Amazon and Flipkart.

· Deals: The Bajaj Finserv EMI Network Card gives you access to exclusive discounts and cashback offers. Buy your products online and get coupon codes on the product page and apply them during checkout for more discounts.

· Quick Delivery: Buy products from the EMI Store using the EMI Network Card and avail of a 24-hour delivery right at your doorstep. You can also bypass the hassle of bringing home cumbersome gadgets by yourself.

· Zero Down Payment: Another benefit of shopping on the EMI Store using the EMI Network Card is the zero down payment facility extended on select items. By availing this facility, you won’t have to make any down payment while purchasing the item.

· Avoid Paying Extra: The Bajaj Finserv EMI Network Card makes you sign an ECS mandate. Thus, you could go through the auto-debit feature to make sure every payment is made on time. There are no hidden charges that you need to worry about. There is no chance of falling into a debt trap because you cannot pay a minimum amount and let the outstanding amount be carried forward. Although a strict feature, it keeps you in good financial stead. This is only logical because you would have accounted for your expenses while purchasing the product, and made the purchase upon thinking it was suitable.Sort the best products by brand, features and budget at the Bajaj Finserv EMI Store and prepare your shortlist today! Apply for EMI card so that you can make use of the maximum benefits offered on your purchase.