Greetings! This article welcomes you to a world of seamless small business accounting solutions. Do you want to look at the 12 Best Accounting Softwares For Small Business

which can change the way you handle your finances and its operations.

Whether you are a QuickBooks Online guru or a newbie to Wave Accounting, among other tools. We will unravel in this session a wide array of tools, designed to smoothen out your invoicing time.

Estimate expenses, financial reporting, and other financial processes. It does not matter whether you are contracting, freelancing, or a small business owner. Determining the software that meets your accounting needs to the fullest can be a game changer to your financial management.

Hence, now we can move on to discussing the ultimate plan. Which will result in the elevation of your business to a great extent.

Top 12 Accounting Software for Small Businesses

Let’s delve deeper into the 12 Best Accounting software for Small Business:

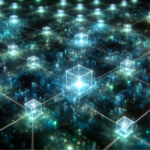

1. QuickBooks Online:

Image credit – QuickBooks Desktop

- QuickBooks Online is among the most favourable online accounting software tools for small enterprises. It comes with a comprehensive set of useful tools like billing, tracking of expenses, reconciliation with the bank, and financial reporting. As well as a preparation of taxes both personal and business ones.

- Users can access QuickBooks Online through any computer with an internet connection. Which can be very helpful for business owners and accountants as they can work together.

- It provides freelancers, small businesses, as well as enterprises, personalised subscription plans. Depending on what type of data they want to learn.

- We use online apps that are integrated with QuickBooks. So, the look of our workflow is very smooth and extended.

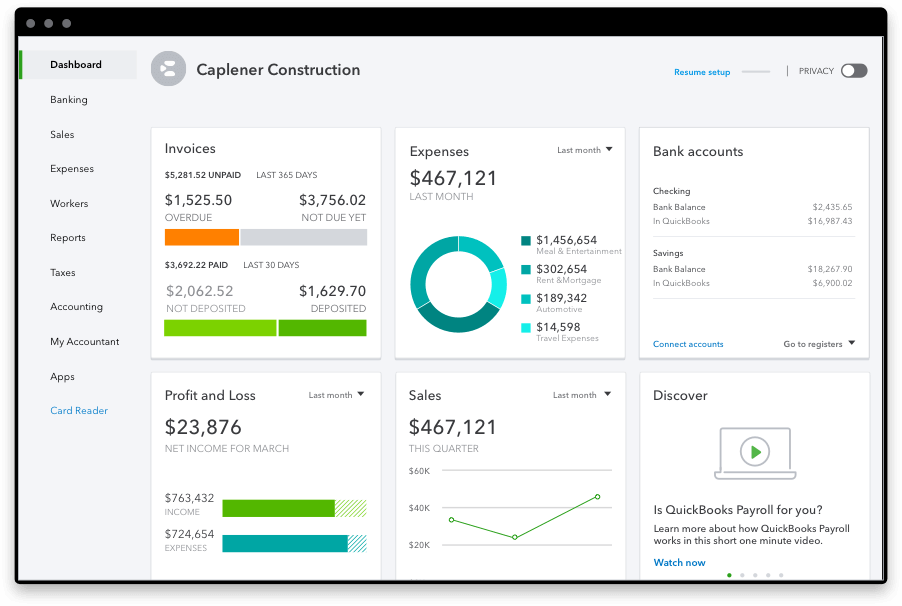

2. Xero:

Image credit – Xero

- Xero gained popularity for its customer friendliness and accounting feature that is quite powerful. It includes invoicing capabilities, back-end solutions for expense tracking, checking account reconciliation, financial reporting, and inventory.

- In the Xero context, users can easily automate repetitive tasks, like invoicing and bill payments. Therefore they will get rid of doing it in the manual way. Which will help them to save time and reduce errors.

- It offers all the collaborative real-time functions which let several users work effectively. And simultaneously through the same data as well.

- The integration of Xero with hundreds of other business tools is the strength of it. That makes it much more useful and robust than the stand-alone product.

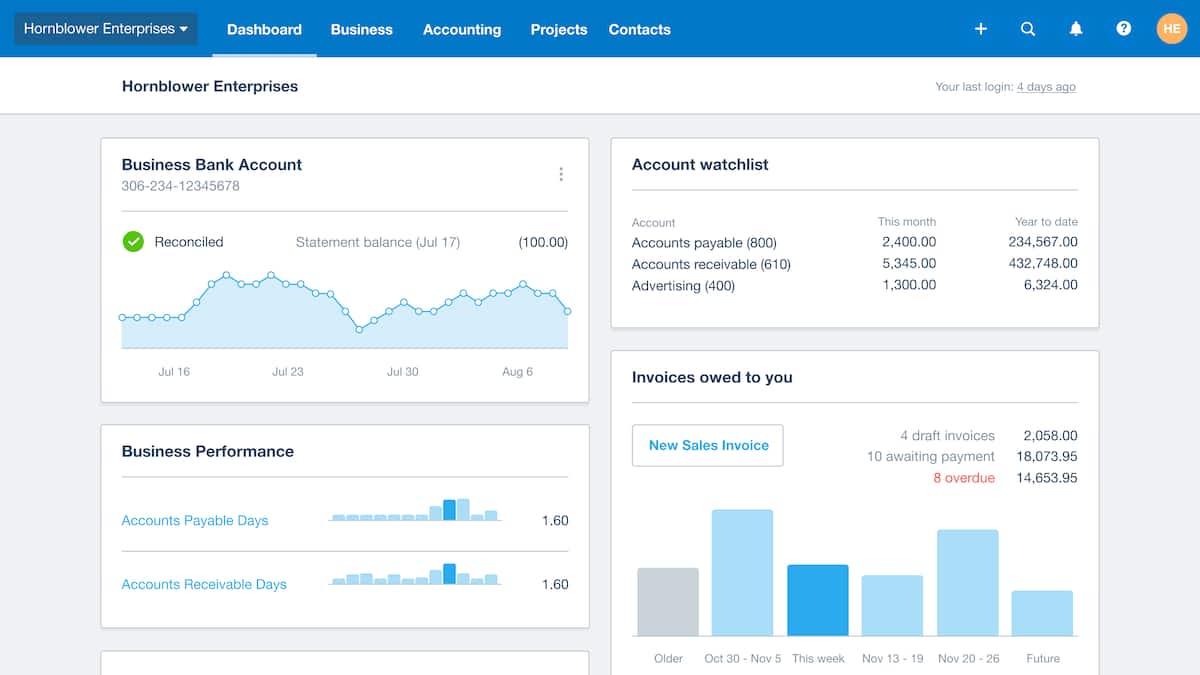

3. FreshBooks:

Image credit – FreshBooks

- FreshBooks is a simple and nicely designed accounting software. In fact it aims at small service-based businesses, freelancers, and self-employed professionals.

- It has tools like time tracking, billing, cost tracking, project planning, and financial reporting.

- FreshBooks’ user-friendly layout and step-by-step getting started directions enable non-accountants. As well as amateurs to manage their finances, with tremendous success.

- It offers automatic invoice processing for recurring operations, late payment reminders and expense categorization. Which result in improved efficiencies while timely cash flow management takes place.

- Through integrating with common payment gateways and apps. FreshBooks ensures the data flow and communications between these systems and tools remain fluid and synchronous.

4. Wave Accounting:

Image credit – Accounts Junction

- Wave Accounting is a free online accounting software tool which is dedicated to those small business owners. Freelancers and consultants who are managing straightforward accounting tasks.

- It provides even simpler ranging functions such as invoicing, expense tracking, bank reconciliation, and basic level financial reporting.

- Wave Accounting has a simple solution and low price. Means a good choice for startup businesses and freelance workers operating to come up to the budget constraints.

- Though it may not have those other nifty features that come with a paid accounting software front line service. Wave offers a range of quick and effective tools that small business owners would necessarily need.

- Wave Accounting connects to payment processors and packages. Invoice processing features under an optional paid service plan for payroll and credit card processing.

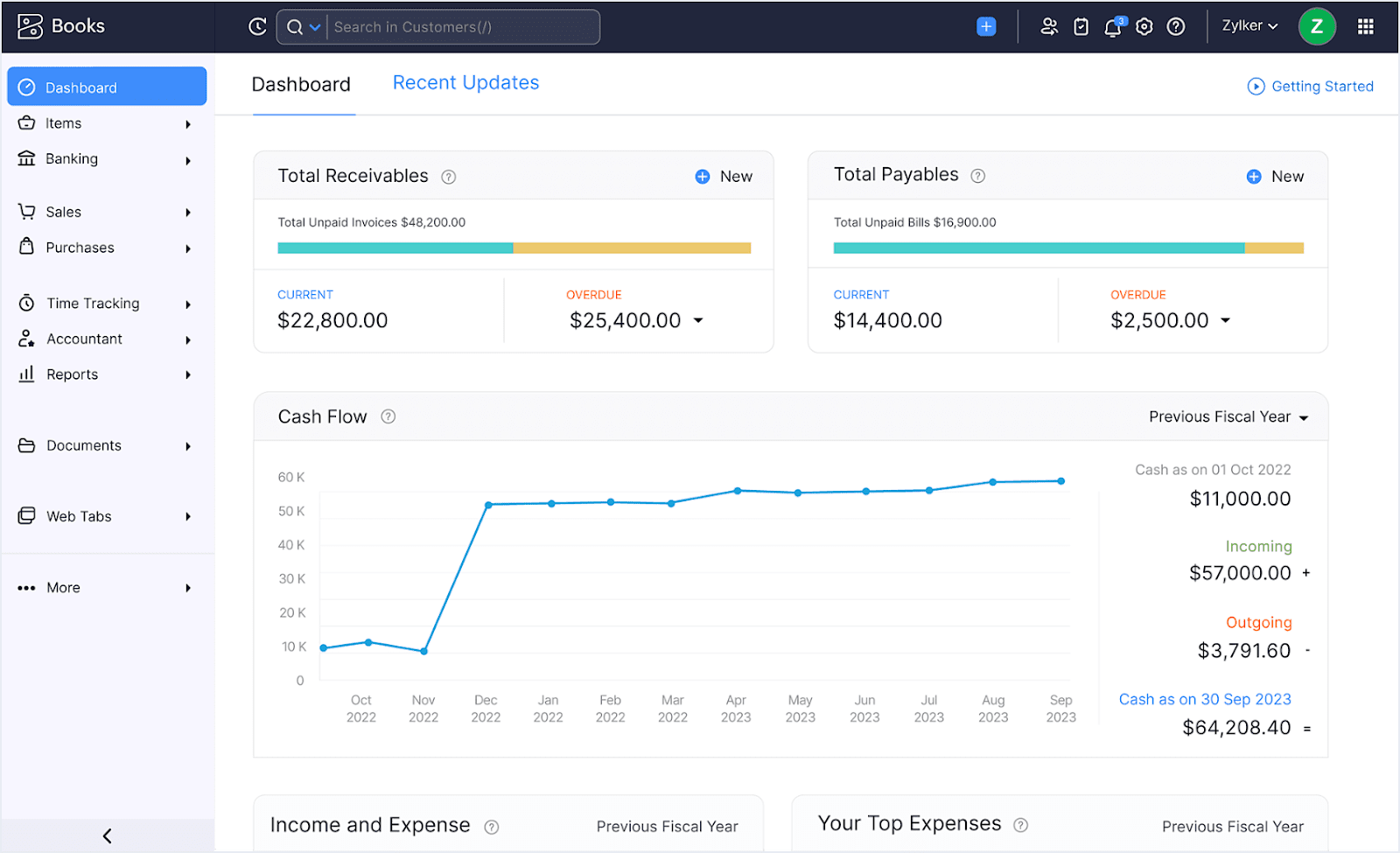

5. Zoho Books:

Image credit – Zoho Books

- Zoho Books is among a range of business solutions. That form part of the Zoho applications inventory of the accounting process & provides business owners with a comprehensive cloud-based accounting solution.

- It offers you an invoicing function, tracks expenses, does bank reconciliation, provides inventory management, projects tracking & easy financial reporting.

- Zoho Books performance is manifold. Being an economical accounting software, it is suitable for start-ups and newly established businesses. While it strives to facilitate their business growth.

- It gives a choice for integration with other Zoho products. The third-party apps for which users can add creating the customised business ecosystem.

- Zoho Books multi-currency handling feature empowers the tool for businessS operating across borders.

6. Sage Business Cloud Accounting:

Image credit – Startups

- Specifically, Sage Business Cloud Accounting, was formerly called Sage One. And now is a cloud-based accounting software solution for micro-businesses.

- It provides billing management, cost tracking, financial statement preparation, and test-tracking options.

- Sage Business Cloud Accounting gives business owners a chance to customise invoices. And quotes both enabling them to present a more professional image to their clients and partners.

- Scale comes into play, letting companies migrate from initial to more elevated Sage accounting solutions just as theirs grows.

- Sage Business Cloud Accounting security features give strong protection to the personal data. Which is important not just for clients but also for businesses of all types and sizes.

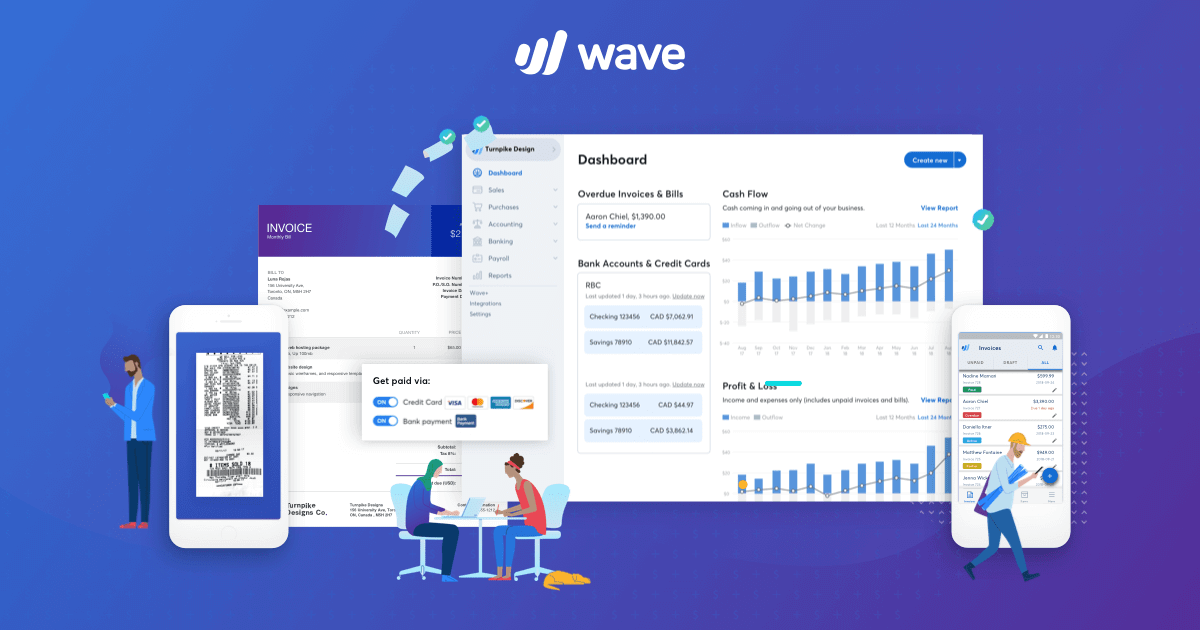

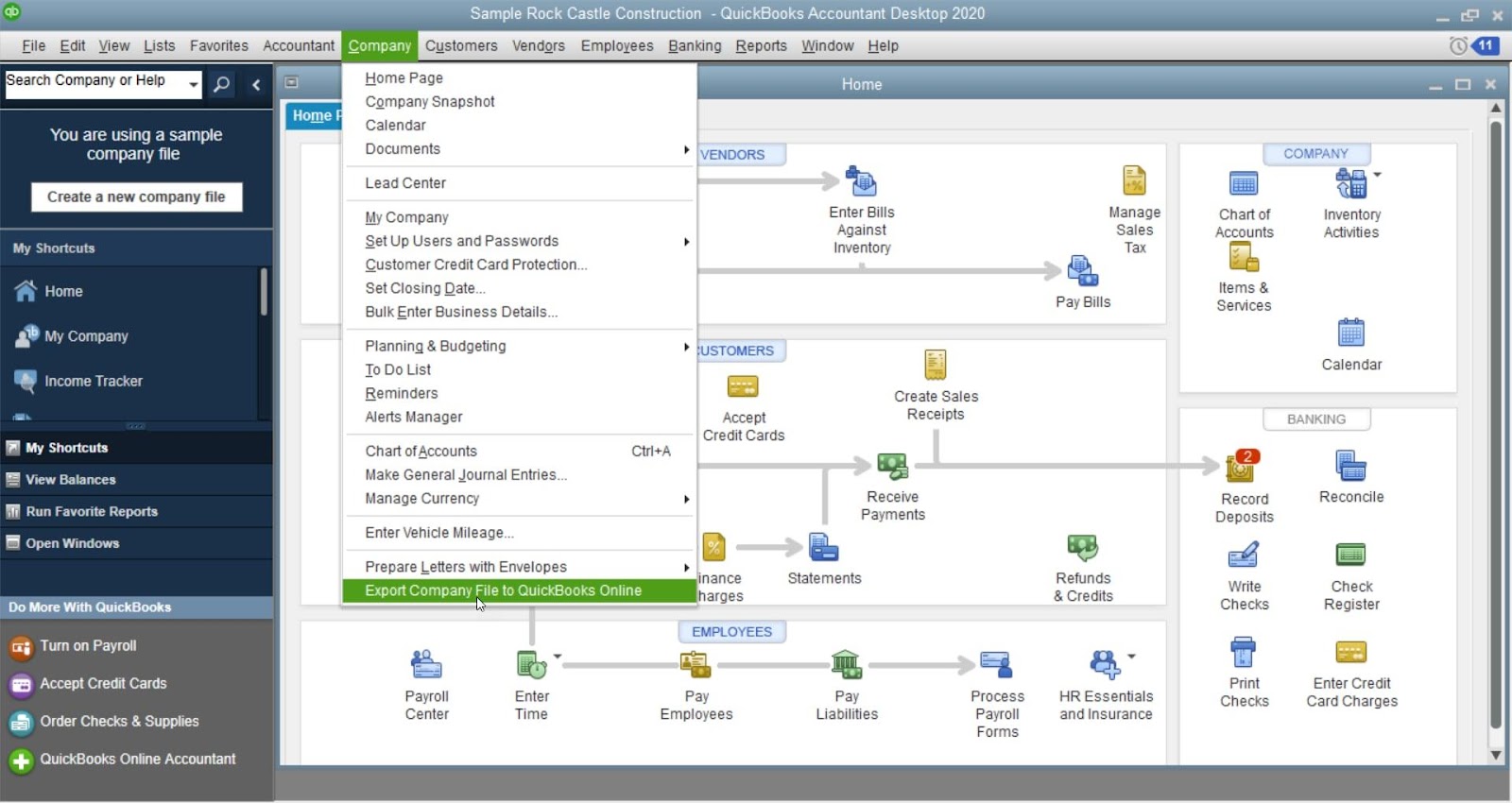

7. QuickBooks Desktop:

Image credit – QuickBooks

- It is the traditional accounting software product that has to be downloaded and installed onto the personal computer. Rather than used on the web-based network.

- It has a detailed accounting package which enables one to do invoices. Keep an eye on their expenses, manage their inventory, run payroll and prepare financial reports.

- For some businesses, QuickBooks Desktop is the top choice due to its high performance; high rate of speed & advanced features.

- Thus, it becomes possible for users to continue working without the necessity to connect to the Internet. And locally access his/her data, which is a great facilitation for the companies with limited Internet access.

- However, for the desktop version of QuickBooks users can compose individualised versions that match different business types.

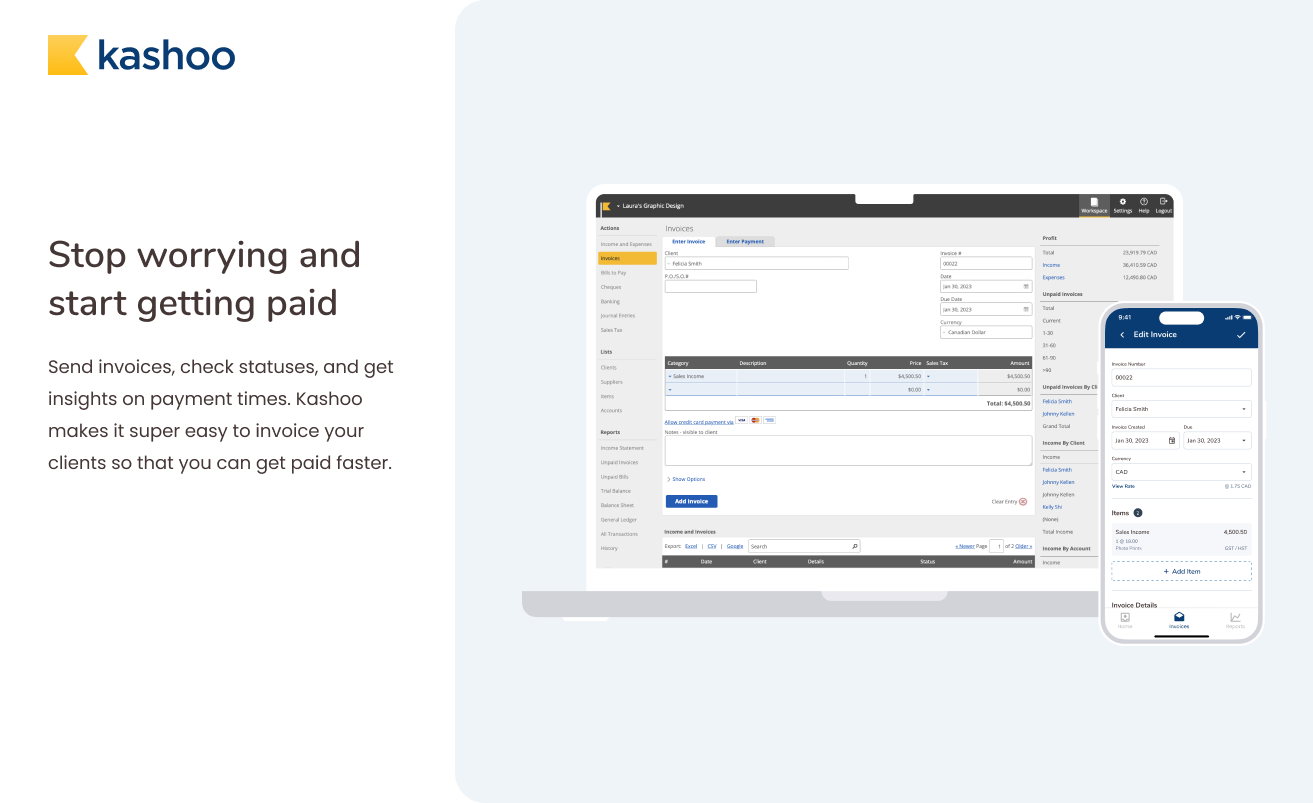

8. Kashoo:

Image credit – Get App UK

- Kashoo is a tool that is perfect for small businesses and freelancers. It is quite easy to understand and it also has high functionality.

- It gives you functionalities, among them Accounts Receivable and Payable, Bank Reconciliation, Financial Statements and multi-currency support.

- Kashee’s intuitive interface and the fact that anyone can use it without the need for an accountant to set it up for them. It is what makes it so easy for people who don’t have accounting backgrounds to use it.

- It accommodates payment processing from major payment processors. As well as allowing integration with relevant business apps, thus building up the strength and simplicity.

- Kashoo has mobile apps for both iOS and Android platforms available to the users. Thus, users can perform essential accounting operations recording and tracking income. And expenses, creating invoices, and preparing reports remotely.

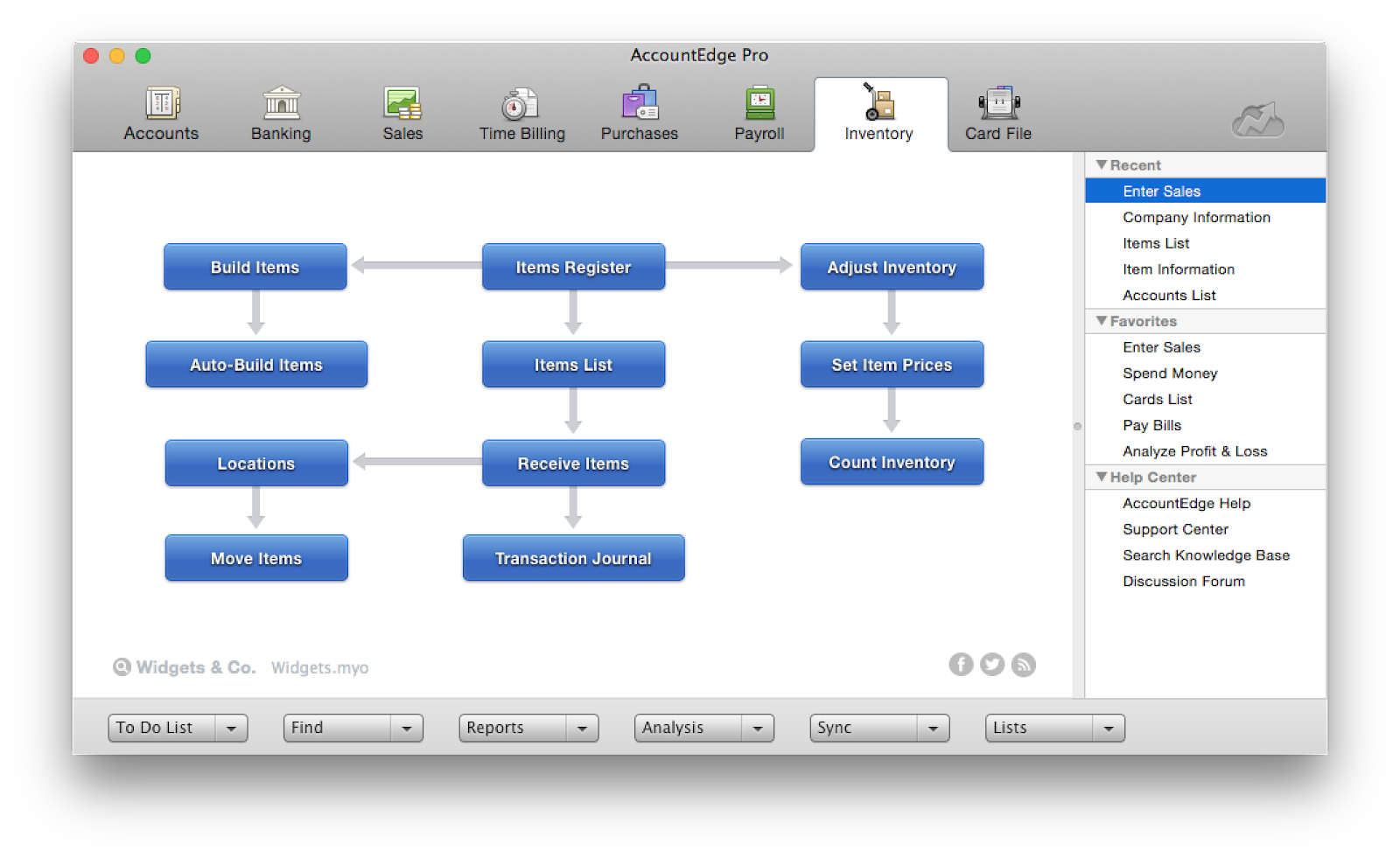

9. AccountEdge Pro:

Image credit – G2

- AccountEdge Pro is a multi-purpose accounting software solution, which is designed for small businesses and individual freelancers.

- It comes complete including functionality such as invoicing, expense checking, inventory management, payroll processing and financial reports.

- AccountEdge Pro offers advanced inventory tracking options, for businesses to have full control over stock levels, sales & purchase orders.

- It provides user-customised reports & dashboards, thus giving users the opportunity to develop financial reports & the performance dashboard.

- The AccountEdge Pro comes with a wealth of security features to guard client-sensitive financial details, such as user rights & data encryption.

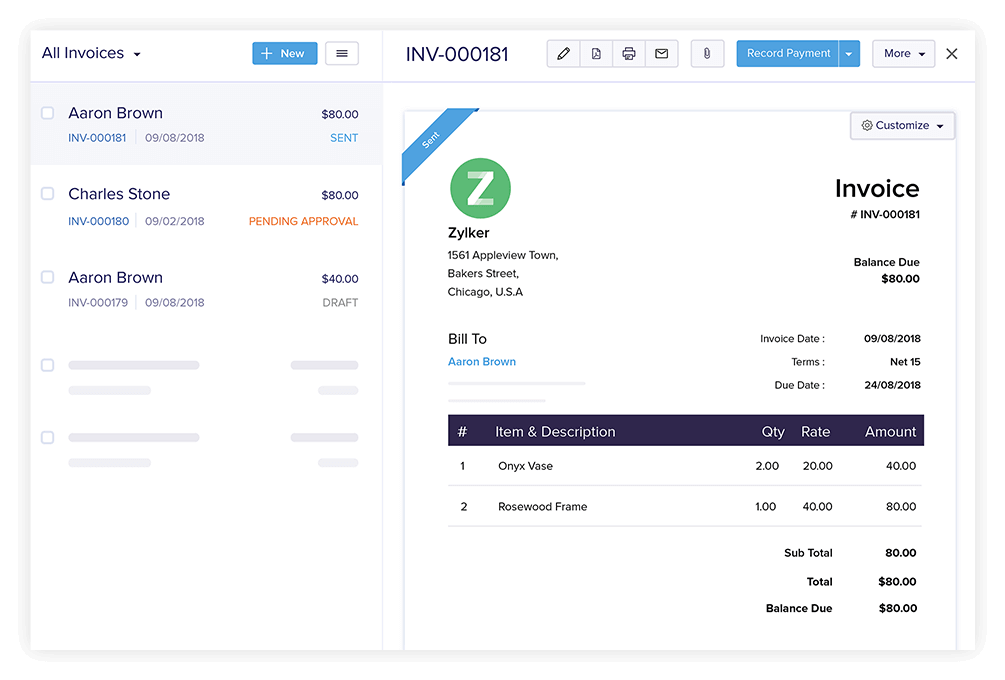

10. Zoho Invoice:

Image credit – Zoho

- Zoho Invoice is a user-friendly software for invoicing and it is recommended for independent contractors, consultants, and small businesses.

- It enables simple invoice creation in various formats, automation of invoicing, expenses tracking & bills on cash acceptance online.

- Zoho Invoice has convenient connectivity with the other Zoho products, as well as the third party apps. Also allowing the users to develop an integrated system in order to streamline their business operations.

- This feature is all about multi-currency support so it is suitable for international businesses which is the case.

- Zoho Invoice also comes with a mobile app, so invoices are not only easy to make. But can be done any time, even while on the go.

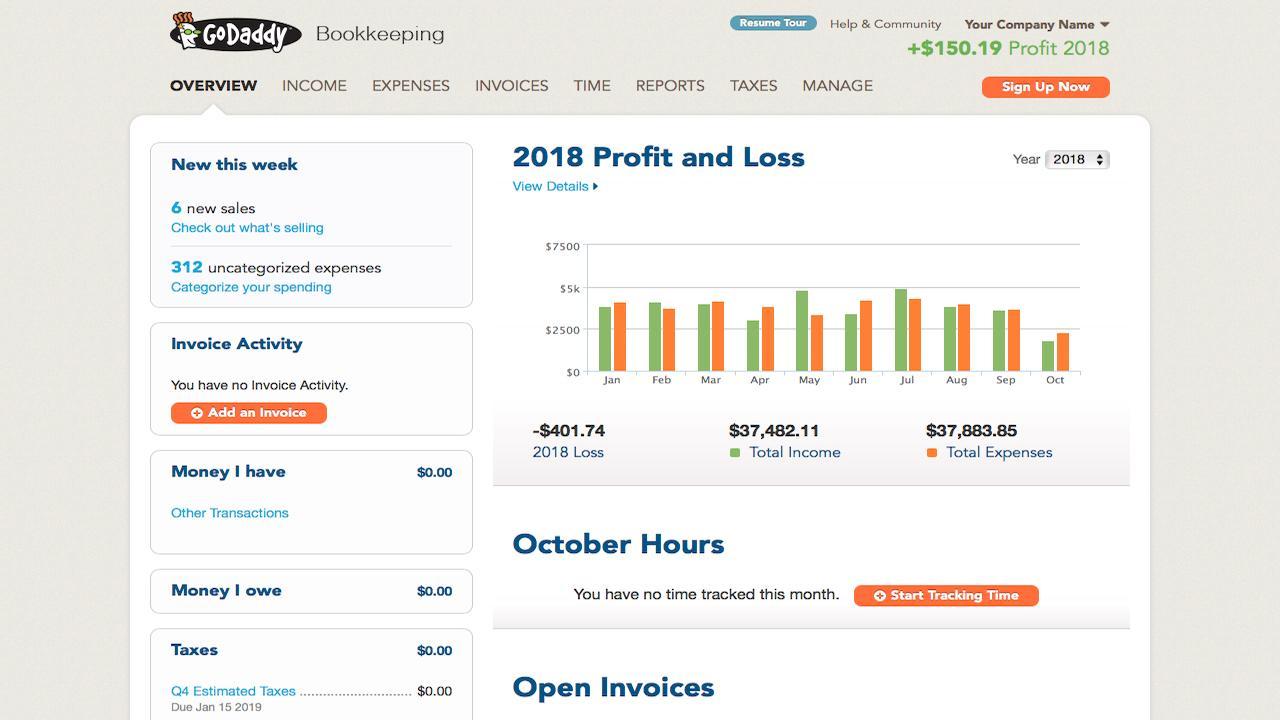

11. GoDaddy Bookkeeping:

Image credit – TechRadar

- GoDaddy Bookkeeping, which used to be named as Outright, is a frill-free accounting software. The package focused on covering the needs of small businesses and self-employed individuals.

- It contains services like income & expenses monitoring, making invoices, taxes handling, and financial reporting.

- The imported transactions from the accounts & credit cards connected through the GoDaddy Bookkeeping makes the manual data entry quite less.

- It gives the necessary accounting apparatus to the users which helps the latter to understand their business finances & tax filing.

- User-friendly interface & fair pricing fill in the affordability gap for small businesses. Which potentially have no or little accounting literacy are two major features of GoDaddy bookkeeping.

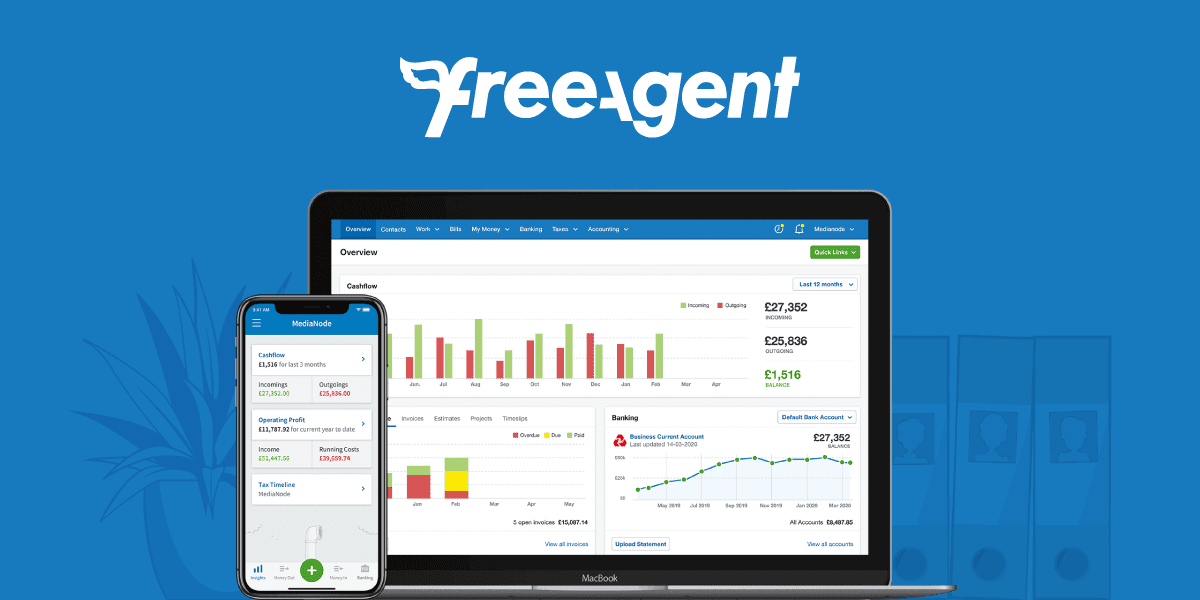

12. FreeAgent:

Image credit – FreeAgent

- FreeAgent is a software accounting solution for freelancers, consultants and small firms. In most cases it makes better sense for individuals running a business with budgets lower than £80K.

- To automate day to day tasks it has invoicing, expenses tracking, bank reconciliation, project management & financial reporting as its features.

- The real-time banking feed that FreeAgent offers is to enable users to categorise and reconcile transactions with no hustle.

- It provides the tax timeline and estimation tools that guide the user to avoid tax-related errors. Thus being in line with the financial commitments.

- FreeAgent integrates with major application payment methods for transactions.And their functionality to be enhanced.

These accounting software options differ sometimes in features, cost, scalability, and user experience. Therefore, it’s very important to put your business’s needs and preferences into consideration before choosing the suitable one.

How To Choose The Right Accounting Software?

Here are five simple steps to choose a good accounting software:

1. Assess Your Business Needs: Start with pinpointing your business’s specific accounting requirements. When considering the program, take into consideration many aspects that include invoicing, expense tracking, inventory control, payroll processing & reporting financial results.

2. Set Your Budget: Set the amount of your investment you can afford to pay towards accounting software. Compare pricing plans of a number of different software solutions that provide all the important features & find an option that fits your budget.

3. Research and Compare Options: Research thoroughly different accounting software choices that might be on the market. Compare their functionality, their users’ reception, their customer service, its simplicity, its scalability, its integrating abilities.

4. Take Advantage of Free Trials: Most accounting software suppliers enable users to try the product free of charge or sample the full version free of charge. These trials will work to tell whether the software is faulty or its functions are weakened to give the topmost functional inputs. That suits your business best.

5. Consider Future Growth: Pick an accounting package that can adapt to as the company evolves and matures along the growth line. Take into consideration software functionality and adaptability. Which enables its usability in a plethora of different business contexts and simultaneous integration with other tools at your disposal.

5 Tips for Effective Accounting In Small Businesses

Here are five tips for efficient accounting in small businesses, each presented as a short step:

1. Keep Detailed Records: Make sure to keep accurate and detailed reports for all financial transactions, that is, invoices, statements, bills and receipts. Employment of account software or spreadsheets is the advisable method for conducting an elaborate income and expenses accounting.

2. Regular Reconciliation: Check bank statements, credit card statements and other financial accounts often to reconcile them. Thus, making any errors and issues a lot easier to be spotted. It aids quite a bit in providing the right information the way it should be and then in return, helping you with accurate financial records of the company.

3. Track Expenses Closely: Evaluate spending patterns purposefully and make it subordinate to its category. It determines cost reduction spots that will help you know how to claim tax deductions and manage your finances even better.

4. Set Aside Funds for Taxes: Make provision for withheld taxes by keeping the cash flow open and available through tax time. Follow the lock of tax deadlines & legal obligations to be in time with the tax payments and comply with the tax laws.

5. Seek Professional Advice: A vital decision you might need to take is to hire a professional accountant to help manage your finances effectively. A professional can present precious strategic advice, tax planning services. And solutions to all the accounting challenges that will enable you to master your business dealings more effectively.

Conclusion

The business of accounting in the small-business realm is a world that is endless and dynamic. Often with inventive methods that are created to fit the needs of everyone. Following the examination and review of the 12 Best Accounting software for Small Business. One can confidently conclude that there are an immeasurable number of tools designed to help businesses manage their finances and invest wisely.

Whether you’re just trying to find something combining together simplicity, scalability, and advanced options. You will surely come across the right technology at your disposal. Through the capability to utilize this accounting software. Which guarantees you with more time savings, fewer errors, and deep insights about the health of your business.

Then, it is your turn to jump directly on the train and experience the possibility of modern accounting technology helping to make a smart decision. Your business is totally worth only top-class services!