As we wait for the crypto to rise again (or perhaps go lower than it’s ever been), blockchain technology confirms its stand as an important player in both society and the economy. Token economy and tokenization are terms we’re beginning to mention regularly in different discussions. For this reason, let’s briefly overview the token economy and its good and bad sides.

What is the token economy?

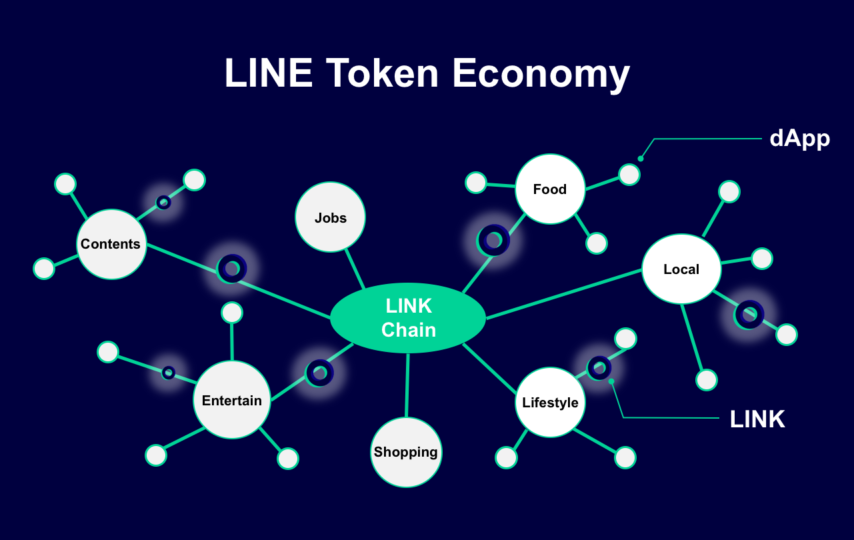

Token economy refers to the type of market where digital tokens represent its assets. That doesn’t mean that a token is merely a crypto coin such as Ethereum or Bitcoin, though. NFTs can be tokens, too, in the forms of artwork, real estate, or even selfies. Whatever the type of asset, you can exchange them peer-to-peer, and smart contracts are there to ensure automation.

What’s the main reason the token economy’s the talk of the internet community? Because it’s helping individuals have more control over their lives in different areas. Surely, efficient and transparent blockchain transactions are one of the main advantages, but there are plenty more.

For example, you can access affordable financial services. You can charge more for your work, regardless of whether you’re a farmer or an artist. Thanks to the token economy, innovators looking for funds can also create their projects faster. Last but not least, one can verify their background, skills, citizenship, healthcare, or whatever asset and credentials.

Of course, none of this would be possible without blockchain, because we use the blockchain to record the ownership of various digital assets. Thanks to this popular distributed database, buyers and sellers no longer need to use only banks or centralized institutions for financial transactions. Blockchain turns to shared community governance for verifying credentials, bookkeeping, finding assets, and so on, without any third party required. It saves time and money, and keeps the business details private.

Main benefits of tokenization

We’ve already mentioned these briefly, but let’s get into more detail on why the token economy is the future.

- Stable and secure — when you make a change to the blockchain and confirm it, it’s really hard to alter it later. If this is what you need to raise your security level, you can be completely at ease. You can store financial data with more security because modifying or deleting it is very challenging once you register it in the blockchain. Therefore, it’s highly reliable to store data in this way.

- Resistant to cyber attacks — when you store blockchain data, you are actually keeping it in thousands of devices on distributed network nodes, not just one server. Each of those nodes then copies the information and stores it in the database. Such a system is extremely resistant to malware and tech failures, as opposed to common databases, which rely on a couple of centralized servers.

- Trustless system — one of blockchain’s nicknames — with tokenization, you verify the transactions via mining, without the need to involve third parties in the business, pay ridiculous fees, or expose your assets.

Therefore, the token economy is a reliable, secure system that prevents unwanted third parties’ interference.

Disadvantages of the token economy

So, why haven’t the markets exploded with the token economy? Because there are still a couple of downsides to bear in mind:

- No data changes — it’s impressive that deleting or altering data once you add it to a blockchain is a real challenge. Yet, sometimes you need to modify the data, and that process is going to be really difficult.

- Storage requirements — have you ever thought about how big a blockchain gets? You need about 200GB of data storage at the very least. Not only that, but the blockchain size seems to be constantly increasing. Consequently, you risk losing network nodes if the log expands too much for downloads and storage.

- Losing private keys — isn’t it annoying how one little slip can tear down your entire savings? Well, that’s what may happen if you lose your private key to the blockchain address! The person with the key can unlock your funds without much trouble. So all those protections are futile if someone else finds the 256-bit number in your keystore.

- Frequent cyber attacks — with AI and machine learning revolutionizing cyberspace, there are going to be more sophisticated attacks on the blockchain. Stealing about $200 million from a crypto startup was one of the most talked about attacks last year. One of the most common tricks is phishing emails in which hackers represent as wallet providers in order to get your private key.

Building a token economy with blockchain isn’t that straightforward and risk-free after all. However, we’d say the advantages outweigh the cons if you’re careful enough.

Future outlook

Despite the shocking crypto market drop in July 2022, the token economy seems to have a bright future in front of it.

With the possibility for almost any asset, from cryptos to NFTs, to have a blockchain representation, the token economy has extraordinary thriving potential. Consequently, we can expect a revolution in financial markets and industries.

For example, as BlackRock and Goldman Sachs are getting interested in tokenization, estimations are that their competition will follow. Goldman Sachs has just made history by issuing the first fully digital bond on a private blockchain. It’s a huge step since it’s the first syndicated digital bond by a public institution that showed up on the Luxembourg Stock Exchange’s Securities Official List.

To sum up, the token economy is continuing to go mainstream in 2023. Judging by the first looks of it, this is going to be one exciting year.