As a savvy trader, it’s essential to understand the relationships between currency pairs and how they impact your trading strategies. One of the most important relationships to comprehend is the correlation between the DXY and major currencies. The DXY is a weighted index of the US dollar against a basket of six currencies, including the euro, yen, and pound sterling. In this article, we will explore the correlations between the DXY and other major currencies and provide insights on how to incorporate this information into your trading strategies.

Understanding DXY

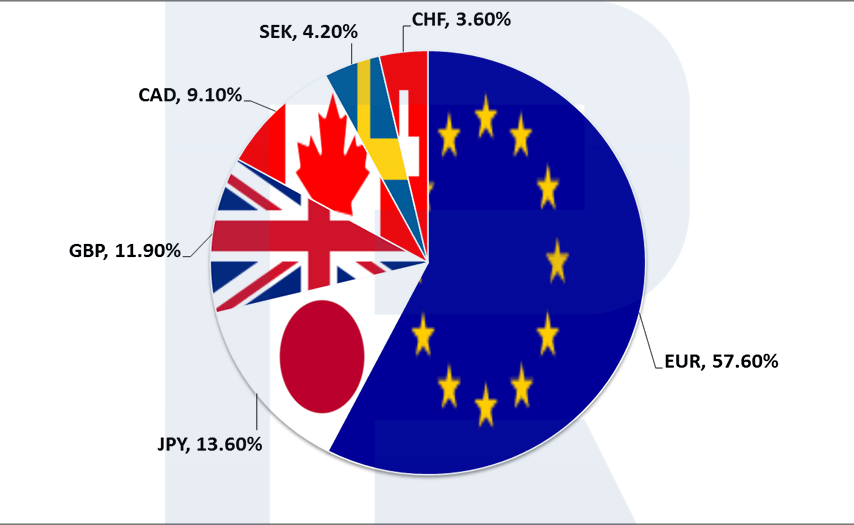

The DXY is an index that measures the value of the US dollar against a basket of six major currencies. It was created by the Intercontinental Exchange (ICE) in 1973 and is widely used as a benchmark for the performance of the US dollar. The six currencies included in the index are the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc. The index is weighted based on the trade flows between the US and the other countries, and the currencies in the basket are updated periodically to reflect changes in trade patterns.

The DXY is a useful tool for traders because it provides a way to measure the overall strength of the US dollar relative to other major currencies. When the DXY rises, it means that the US dollar is gaining strength against the other currencies in the basket. Conversely, when the DXY falls, it indicates that the US dollar is losing value against the other currencies.

Correlations between DXY and Major Currencies

To understand the correlations between the DXY and other major currencies, we need to look at the individual currencies in the basket. The euro, for example, has a negative correlation with the DXY. This means that when the DXY rises, the euro tends to fall in value, and when the DXY falls, the euro tends to rise in value. The yen and the Swiss franc, on the other hand, have a positive correlation with the DXY. This means that when the DXY rises, the yen and Swiss franc tend to rise in value, and when the DXY falls, they tend to fall in value.

The correlations between the DXY and the Canadian dollar, British pound, and Swedish krona are more complicated. These currencies have both positive and negative correlations with the DXY, depending on the economic conditions at the time. For example, during periods of economic uncertainty, the British pound and the Canadian dollar tend to have a negative correlation with the DXY, while during times of economic growth, they tend to have a positive correlation.

Impact on Trading Strategies

Understanding the correlations between the DXY and major currencies can have a significant impact on your trading strategies. One way to incorporate this information into your trading is by using the DXY as a leading indicator for currency pairs. For example, if you notice that the DXY is rising, and you have a long position in the euro, you may want to consider closing your position or taking a short position.

Another way to use the DXY is to look for divergences between the index and individual currency pairs. For example, if the DXY is rising, but the euro is also rising, it could indicate a potential buying opportunity in the euro. On the other hand, if the DXY is falling, but the yen is also falling, it could suggest a potential selling opportunity in the yen.

Conclusion

In conclusion, understanding the correlations between the DXY and major currencies is crucial for developing effective trading strategies in the foreign exchange market. By using the DXY as a leading indicator and looking for divergences, traders can gain valuable insights into market trends and identify potential trading opportunities. Staying vigilant and adapting to changing market conditions is key to success in the fast-paced world of forex trading.