Disposable Personal Income (DPI), as defined by the US BEA, is the income that remains after taxes have been paid. It represents the amount of money available for investing, saving for retirement/a rainy day, or spending purposes. This net pay amount is what you have available after taxes have been paid on your salary or wages. The greater the figure, the healthier the national economy. Of course, inflationary pressures have a powerful effect on the buying power of after-tax dollars. In simple terms, more DPI translates into more buying power, and vice versa.

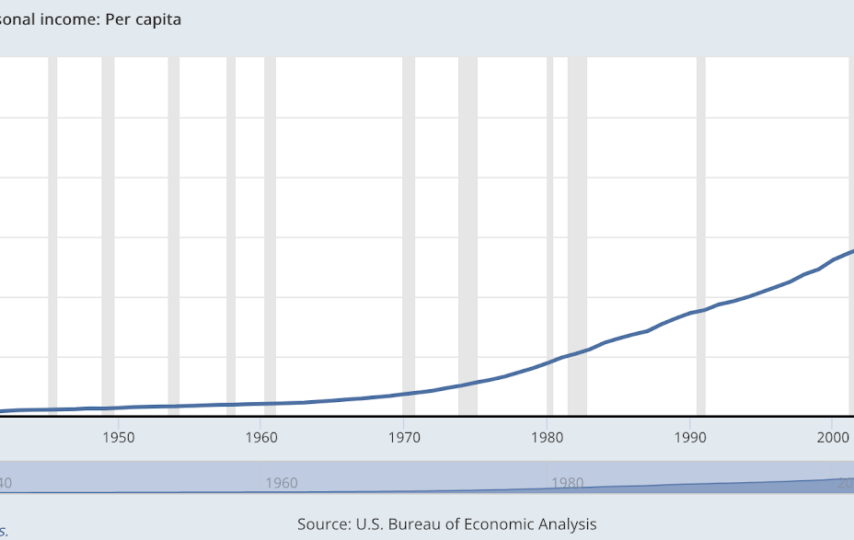

Statistics compiled from 2022 will indicate that the typical American wage earner has around $56,063 in DPI annually. Interestingly, the disposable personal income per capita has flatlined since 2020. This is largely due to the suppressive impact of the pandemic, out-of-control inflation, and increasing geopolitical uncertainty. A brief exploration of the DPI per capita between 2018 and 2022 paints an interesting picture:

- DPI 2018 – $47,002

- DPI 2019 – $48,885

- DPI 2020 – $52,360

- DPI 2021 – $56,159

- DPI 2022 – $56,063

The last two years of data collected by the US Bureau of Economic Analysis (2021 and 2022) indicate a clear decline in DPI. While a slight improvement characterized 2023, inflationary pressures remain. At the last count, personal income and outlays for July 2023 increased by 0.2%, or $45 billion, based on estimates. At the same time, DPI increased by <0.1%, or $7.3 billion. The real bugbear in the equation is the declining real DPI (down 0.2% in July 2023) and the real PC +0.6%.

Source: BEA Personal Income and Outlays, July 2023

Tech Solutions to Assist with Rising Costs and Declining Real DPIs

As early as 2021, 60% of organizations nationwide attested to significant wage inflation (Gartner), the consumer price index reflecting sharp increases yearly. This is particularly hurtful on basic items, including groceries, fuel, and essentials. Technology mitigates rising prices by tackling the most urgent costs head-on.

From a consumer POV, cost savings are sacrosanct. That’s why the following tech solutions prove their worth:

Grocery Cash Back App – In today’s economic landscape, marked by rising costs and shrinking disposable personal incomes, a novel tech solution is offering a smart way for consumers to counteract these financial pressures. This technology focuses primarily on daily essentials such as fuel and groceries, areas where cost savings are most needed.

Users can earn back a portion of their spending on these necessities by utilizing this tech. The process is straightforward: users receive cash back with a reputable grocery cash back app when making regular purchases at various participating gas stations and grocery stores.

The app is particularly advantageous as it covers over 100,000 locations, including gas stations, grocery stores, and restaurants, ensuring users can earn cash back close to home. This isn’t about points or complex reward systems; it’s about real money that can be transferred directly to users’ bank accounts or converted into e-gift cards for popular retailers.

This solution stands out because of its simplicity and alignment with everyday activities. Whether refueling the car or stocking up on groceries, users effortlessly earn back a significant percentage of their expenditures.

Now that every penny counts, innovative approaches like this offer financial relief and instill a sense of smart spending and saving. Consequently, it becomes a valuable tool in managing household budgets more effectively, especially in economic strain.

Buy Now Pay Later – A somewhat controversial way consumers are ‘buying now’ and ‘paying later’ with apps includes services like AfterPay, Klarna, and Affirm. This company, and several others like it, divide payments up. Unlike a credit card, it makes bigger purchases more affordable through installment systems. The stats suggest that many consumers are using such services across the country.

However, stretching out payments over time is not necessarily a cost-effective way to deal with challenges since the indebtedness remains. On a plus note, no credit checks are required for qualification purposes – so there’s no impact on a credit report. However, there are late fees

and interest if customers fall behind on payments. Regular payments of buy now, pay later plans do not positively impact your credit report either. These low-risk alternatives to credit cards may be beneficial to some, but they don’t put cash back in your pocket.

Smart Carts – for Consumers and Businesses – this solution benefits consumers and businesses since it reduces overall costs. Bypassing checkout lines allows grocery stores to reduce labor costs, improve efficiency, and pass on cost savings to consumers.

Dubbed a friction-removing solution, smart carts may be a game changer for the economy. According to Coresight Research, grocery stores have witnessed a 3.1% decline in market share between 2017 – 2022, from 69.7% to 66.6%. That translates into billions of dollars lost.

From a business POV, technology is increasingly being used with things like:

- Digital wallets for frictionless checkouts

- Internet of Things and artificial intelligence technology

- Robotics, automation, inventory management et cetera

- Sensors on shelves – smart shelves – using real-time data and AI

In an economy marked by fluctuating Disposable Personal Incomes and rising living costs, innovative tech solutions like a grocery cash-back app offer a practical way to ease financial burdens. By seamlessly integrating into daily activities like fueling up or grocery shopping, this app empowers users to earn back a significant portion of their expenses, effectively boosting their spending power. These tools are valuable for managing household budgets and navigating economic challenges smartly and efficiently.