As we step into 2024, the cryptocurrency landscape in the United States is undergoing significant transformations, presenting both challenges and opportunities for investors. This article delves into the top 10 emerging trends in the crypto world, highlighting how they are reshaping investment strategies and influencing the financial landscape.

From innovative blockchain applications to the burgeoning field of decentralized finance (DeFi), we explore how these trends are unfolding, especially in states like Kentucky, offering unique insights for crypto enthusiasts.

The Rise of Decentralized Finance (DeFi): New Opportunities in Peer-to-Peer Transactions

Decentralized finance, commonly known as DeFi, is revolutionizing the way we think about financial transactions. Unlike traditional banking systems, DeFi operates without central authorities, using blockchain technology to facilitate peer-to-peer transactions. This trend is gaining momentum, offering investors more control over their assets and opening up new avenues for investment that were previously inaccessible.

Blockchain Beyond Cryptocurrency: Diversifying Into Different Industries

Blockchain technology, the backbone of cryptocurrency, is now extending its reach beyond digital currencies. Industries ranging from healthcare to supply chain management are adopting blockchain for its transparency, security, and efficiency. This expansion offers crypto investors an opportunity to diversify their portfolios by investing in blockchain applications across various sectors.

Regulatory Landscape Shifts: Navigating New Policies

As crypto gains popularity, governments are working to establish regulatory frameworks. These changes can significantly impact investment strategies. Staying informed about these regulatory shifts is crucial for investors to ensure compliance and capitalize on new opportunities arising from regulatory clarity.

The Growth of Crypto Derivatives: Expanding Investment Options

Crypto derivatives, like futures and options, are becoming increasingly popular. They provide investors with tools to hedge against volatility, speculate on price movements, and gain exposure to cryptocurrencies without owning the underlying assets. This trend is opening up new strategies for seasoned investors.

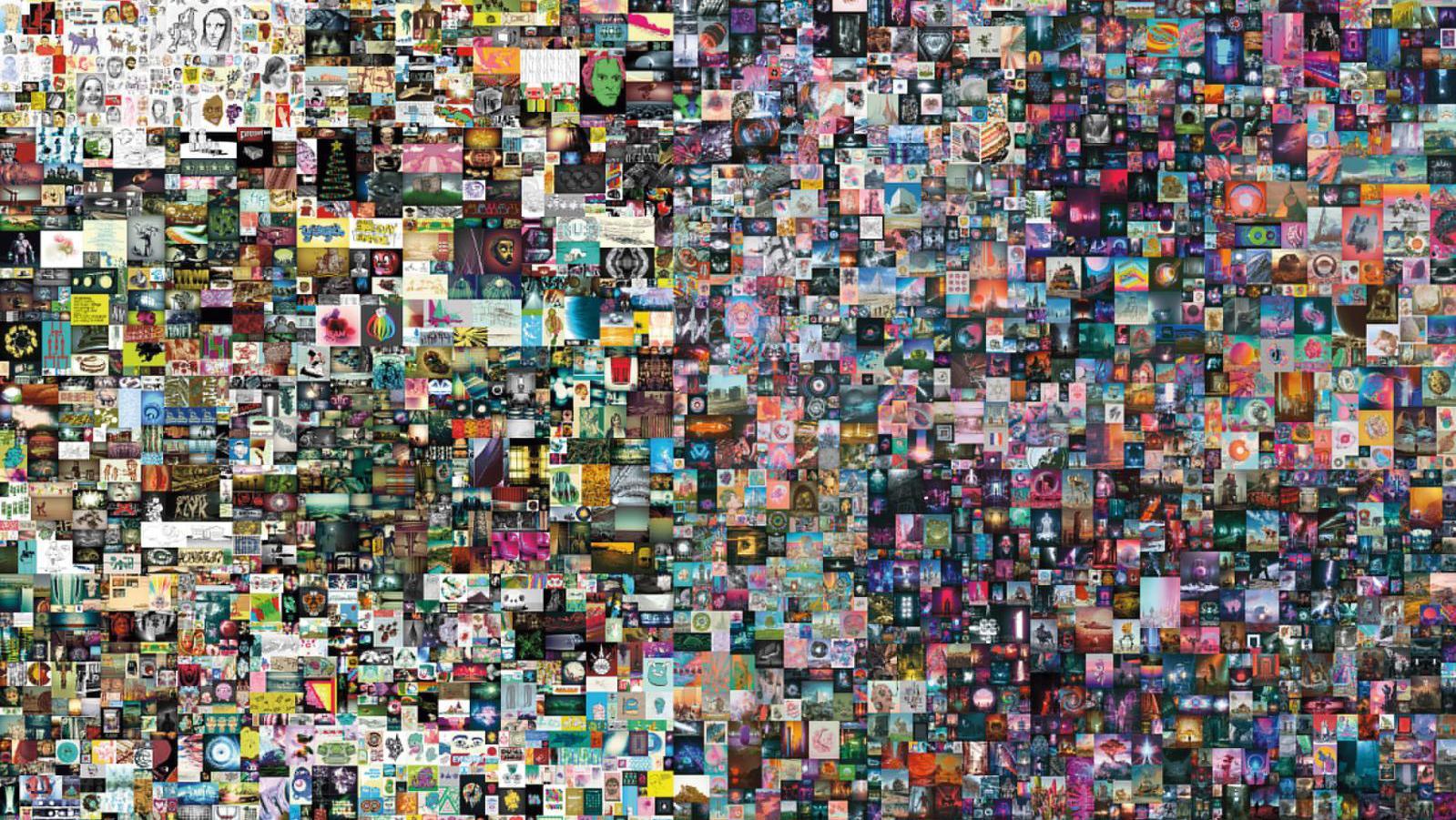

The Emergence of NFTs: Exploring Digital Asset Ownership

Non-fungible tokens (NFTs) are redefining the concept of digital ownership, turning everything from art to music into unique, verifiable assets on the blockchain. This trend is attracting a new wave of investors interested in the intersection of technology, art, and finance.

Enhanced Security Measures: Safeguarding Digital Assets

As the crypto market grows, so does the need for robust security measures. Enhanced security protocols and innovative safeguarding solutions are being developed to protect investors’ digital assets from cyber threats, making the crypto space more secure and trustworthy.

Integration of Cryptocurrencies in Mainstream Finance

Cryptocurrencies are increasingly being integrated into mainstream financial systems. This integration is not only legitimizing digital currencies but also providing traditional investors with easier access to the crypto market.

The Advent of Central Bank Digital Currencies (CBDCs): The Future of Digital Fiat

Many countries are exploring or launching their own digital currencies, known as Central Bank Digital Currencies (CBDCs). This trend could redefine the future of money, providing a bridge between traditional fiat currencies and digital assets.

Crypto and ESG (Environmental, Social, Governance) Concerns: Balancing Profit and Responsibility

The crypto industry is increasingly focusing on ESG concerns, addressing issues like energy consumption and social responsibility. This shift is attracting investors who are looking for opportunities that align with their values.

The Proliferation of Crypto Education and Literacy: Empowering Investors Through Knowledge

As the crypto market evolves, the need for education and literacy in this field grows. More resources are becoming available to help investors understand and navigate the complex world of cryptocurrency.

For those in the Bluegrass State looking to engage in crypto trends and possibly enhance their experience, exploring the BetMGM Kentucky platform might add an exciting dimension to their investment journey in different categories like sports. Stay tuned as these trends shape the crypto market, influencing investment strategies and reshaping the financial landscape across the United States.

Final Thoughts

As 2024 approaches, the cryptocurrency landscape in the United States is undergoing a transformative phase, presenting a kaleidoscope of opportunities and challenges for investors. The trends identified in this article, ranging from the rise of decentralized finance (DeFi) to the growing importance of crypto education, are reshaping not just investment strategies but the entire financial ecosystem.

For investors, especially in states like Kentucky, adapting to these changes is crucial for staying ahead in the dynamic world of cryptocurrency. The integration of digital assets into mainstream finance, coupled with advancements in blockchain technology and the surge in crypto derivatives, signifies a new era in the financial sector.

As we embrace these changes, it’s essential to balance innovation with responsibility, ensuring that investments align with ethical and sustainable practices. The future of crypto holds immense potential, and staying informed and adaptable will be key to navigating this exciting journey.