Are you prepared to take charge of your financial destiny & confidently negotiate the complicated world of taxes? Understanding your choices is crucial whether you are a seasoned taxpayer or are new to the process.

In this post, we set out on a quest to investigate Jackson Hewitt’s reviews, throwing light on the experiences of genuine clients who have trusted this renowned tax preparation service provider with their tax demands.

You will acquire insightful views on what Jackson Hewitt has to offer via their experiences & insights, assisting you in making an educated choice on the course of your own tax preparation.

So let’s explore Jackson Hewitt’s world & see what actual individuals think of their tax services.

Jackson Hewitt: Your Ultimate Tax Partner

In the US, Jackson Hewitt is a well-known company that offers tax preparation services. It is well-known for its proficiency in helping both people & companies with their tax-related issues.

By providing both in-person & online tax preparation services, Jackson Hewitt gives clients the freedom to choose the option that best suits their financial circumstances.

The company’s tax experts & technology technologies advise customers through the tax filing process, optimizing refunds & minimizing tax obligations, using a network of physical locations & an accessible online platform.

For anyone looking for qualified tax help, Jackson Hewitt is a reputable brand in the business because of its dedication to providing thorough & trustworthy tax solutions.

Features of Jackson Hewitt

The tax preparation service company Jackson Hewitt is known for the following five characteristics:

1. In-Person Tax Preparation:

Jackson Hewitt has a network of physical locations around the country where clients may make appointments & consult with licensed tax advisors.

These experts work with customers to collect the relevant tax records, talk about their financial conditions, & correctly prepare & submit their tax returns.

2. Online tax preparation:

For those who prefer to do their tax returns from the convenience of their homes, Jackson Hewitt provides an online platform.

Customers may obtain software that is simple to use & walks them through each stage of the tax preparation process.

This platform often has features that increase refunds & guarantee legal compliance.

3. Maximum Refund Guarantee:

Jackson Hewitt often promotes to its consumers a “Maximum Refund Guarantee.” This implies that, depending on the information supplied, they promise to work with customers to get the largest tax return possible, within the parameters of tax laws.

4. Advance Tax Refund Options:

Jackson Hewitt has made advance tax refund alternatives available to qualified clients, enabling them to receive a part of their anticipated tax return before the IRS has finished processing it.

For those who want quick access to money, this function may be extremely useful.

5. Audit Assistance:

Customers of Jackson Hewitt who employ their services are often provided with audit support. Jackson Hewitt offers aid & direction in navigating the audit process in the event that a client’s tax return is under investigation by the IRS or state tax authorities.

Services Offered by Jackson Hewitt

Image credit – Techmagazines

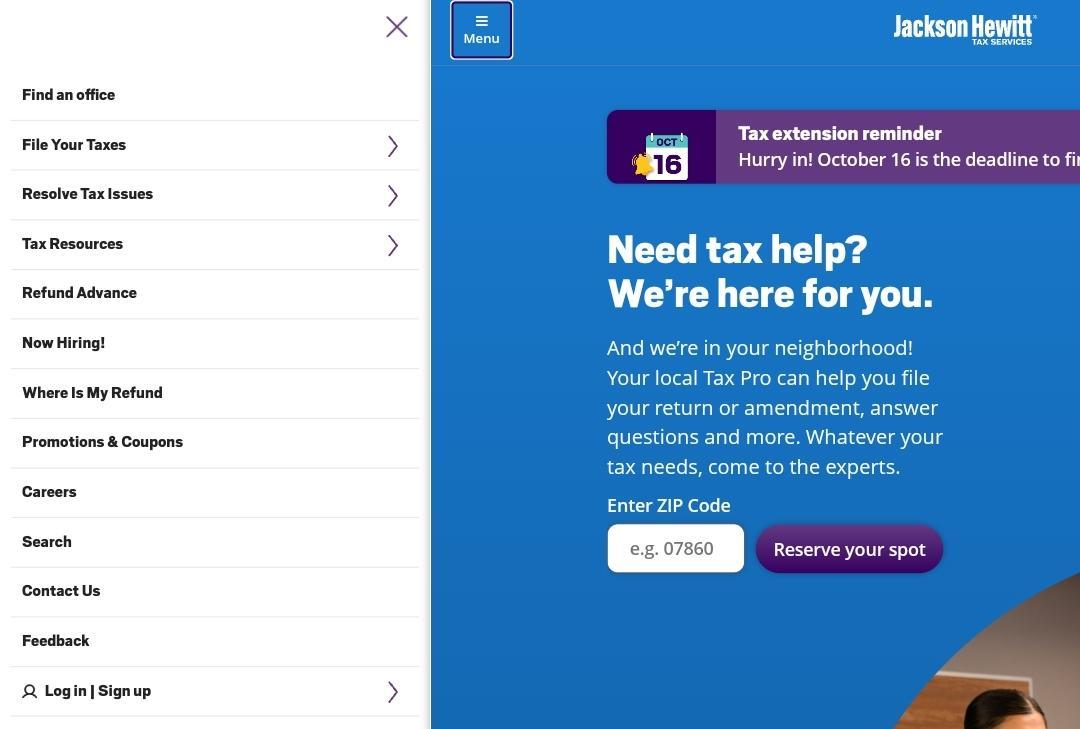

In order to assist people & companies with their tax preparation & financial requirements, Jackson Hewitt principally provides a variety of tax-related goods & services. The following are some of the main services that Jackson Hewitt normally provides:

1. Tax Preparation Services:

Tax preparation services are offered by Jackson Hewitt to both individuals & companies.

Customers may either utilize the company’s online platform to prepare & submit their taxes themselves with assistance & help.

They can visit actual Jackson Hewitt locations to have their taxes filed by licensed tax experts.

2. Online Tax Filing Software:

Jackson Hewitt provides online tax preparation software that enables customers to input their tax data, determine their tax due or refund, & electronically submit their federal & state tax forms.

3. Tax refund advance payments:

Jackson Hewitt has provided tax refund advance options, allowing qualified clients to receive a part of their anticipated tax refund as an advance before the IRS finishes their return.

These possibilities vary by year & the promotions that are available. Those who want quick cash may find this to be extremely helpful.

4. Tax Identity Theft Services:

Services to Help clients Avoid Tax Identity Theft Jackson Hewitt may provide services & resources to help clients avoid tax identity theft & support them if they do become victims of identity theft or tax-related fraud.

5. Audit Assistance:

Customers who use Jackson Hewitt to prepare their tax returns frequently get audit help from the business. This aid may take the form of pointers on how to react to audit notifications & assistance in navigating the audit process.

6. Tax Planning & Consultation:

Jackson Hewitt’s tax specialists may assist customers understand their tax responsibilities, reduce tax payments, & make plans for next tax seasons.

7. Refund Transfer alternatives:

Jackson Hewitt often provides refund transfer alternatives so that clients may decide to pay their tax preparation costs out of their return rather than up front.

8. Virtual & remote services:

Jackson Hewitt may provide remote & virtual tax preparation services, enabling clients to collaborate with tax experts through video conferencing & submit their taxes from any location, depending on the year & changing circumstances.

Jackson Hewitt Review

A tax preparation firm with almost 40 years of experience is Jackson Hewitt. Customers have used it to submit more than 60 million refunds. The business provides several tax preparation options, such as in-person, online, & mobile filing.

Based on more than 1,400 Jackson Hewitt reviews, Jackson Hewitt has a general rating of 3.8 out of 5 stars on ConsumerAffairs. Customers often compliment the company’s accessibility, affordability, & welcoming personnel. Customers have, however, also voiced concerns about lengthy wait periods & mistakes on their tax returns.

Jackson Hewitt’s Subscription Plans

There are several subscription options available from Jackson Hewitt, each with its own features & costs. The key plans are as follows:

Easy: Those with straightforward tax returns should use this strategy. It includes the Saver’s Credit, e-filing, & up to two jobs. For both federal & state returns, the cost is $25.

Easy+: For people with somewhat more complicated tax returns, this solution is available. It offers the Saver’s Credit, e-filing, & unlimited state returns, along with a maximum of two employment. For both federal & state returns, the cost is $49.

Deluxe: For people with more complicated tax returns, use this strategy. It has extra features including investment income, student loan interest, & education credits, as well as up to two employment, the Saver’s Credit, e-filing, unlimited state returns. Federal & state returns cost $69 each.

Entrepreneur & Self-Employed: Taxpayers who are self-employed or own rental properties are eligible for this scheme. It has all the features of the Deluxe plan plus extras including Schedule C, Schedule F, Schedule K-1, & deductions for rental property. For both federal & state returns, the cost is $129.

Jackson Hewitt also provides a range of add-on services, such audit support & electronic signing, in addition to existing subscription levels. Depending on the plan you choose, the costs for these services change.

Conclusion

In conclusion, Jackson Hewitt reviews provide a glimpse into the perceptions of people & companies looking for trustworthy tax preparation services.

We have learned a lot about the positive & negative aspects of this reputable tax service provider from the perspectives of both pleased & dissatisfied clients.

As you begin your tax journey, use these evaluations as a resource to educate your decision-making so that it is in line with your unique requirements & financial objectives.

Remember that although reviews may provide insightful viewpoints, individual situations might change, so it’s important to speak with Jackson Hewitt personally to find out how their services can best fit your specific tax needs.

Meta Description