Hello & welcome to the fascinating world of trading Apple stock on eToro! The voyage of comprehending & utilizing the power of Apple’s stock price is an exhilarating adventure, regardless of whether you are an experienced investor or a curious newbie.

We’ll set out on a trip to investigate the ins & outs of trading AAPL shares on the eToro platform in this post. We’ll examine the current Apple Stock price on eToro, unearth significant insights, & provide you with the information you need to negotiate the volatile world of Apple stocks. So buckle up & let’s go on this interactive exploration together!

Elevate Your Trading Experience with eToro: Your Path to Financial Freedom

Image credit – PR Newswire

The well-known social trading & multi-asset brokerage platform eToro has won a lot of praise for the innovative way it handles online trading. When eToro was introduced in 2007, it completely changed the financial sector by enabling consumers to follow & mimic the methods of successful investors.

Both novice & expert investors appreciate the platform because of its user-friendly design, wide selection of tradable assets, & accessibility to a worldwide trading community. With millions of users worldwide, eToro is a market leader in online investing because of its creative integration of social networking & financial trading.

What is the Current Price of Apple Stock on Etoro?

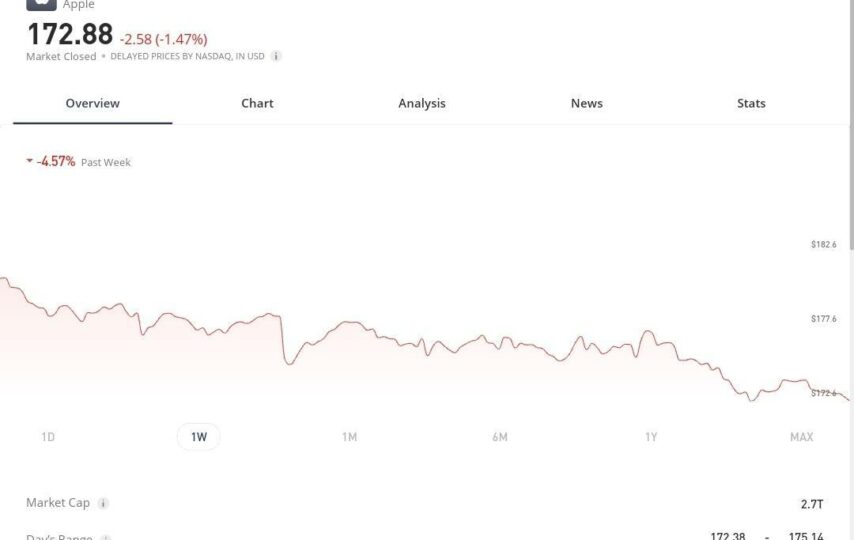

As of October 22, 2023, Apple Inc. (AAPL) is down 1.12% from the previous day’s closing price & the Apple Stock Price on eToro is now trading at $156.34 . Following a strong surge in 2021, Apple’s stock has shown some recent relative steadiness.

Since it is the biggest firm in the world by market capitalization, Apple’s stock is a prominent asset on eToro. Apple, which is renowned for creating ground-breaking goods like the iPhone, iPad, & Mac, has constantly shown profitability & growth, earning it a reputation as a dependable investment option.

Investors should be aware of any hazards that may come with owning Apple stock, however. In the event that it is unable to innovate or stay up with rivals, Apple’s dependence on a small number of core goods, notably the iPhone, creates a danger & might result in diminishing sales. Additionally, the business is vulnerable to economic downturns, & a slowdown in the world economy might lead to a decline in the demand for Apple’s goods.

Investors should take diversification into account when managing their investment portfolios & keep up to date with industry changes in order to balance the attractiveness of Apple’s stability & innovation with these inherent dangers. Consult a financial adviser or do in-depth research to get the most up-to-date market data & personalized investment advice.

How to Trade Apple Stocks on eToro?

There are a few simple procedures involved in trading Apple stocks on eToro. Here is a little explanation on how to accomplish it:

1. Sign Up: Create an eToro account if you don’t already have one. You must finish the registration procedure & give personal information.

2. Verify Your identification: In order to adhere to banking legislation, eToro often requests identification verification. You could be asked to provide a copy of your ID or other supporting documents.

3. Deposit money: You must deposit money into your eToro account before you may trade. Several payment options, including credit/debit cards, bank transfers, & e-wallets, may be used for this.

4. Search for Apple Stock: Sign into eToro when your account has been paid. To discover the stock of Apple Inc., put “Apple” or “AAPL” into the search field.

5. Analyze & Research: It’s crucial to evaluate the performance of the stock, look up current news, & take market trends into account before making a deal.

6. Choose Your Position: Decide whether you want to purchase (going long) or sell (going short) Apple shares in step six, “Choose Your Position.” You would decide to purchase if you think the stock’s price would increase. You would sell if you anticipated a decline.

7. Establish Parameters: Decide how much cash you wish to put into an investment & establish stop-loss & take-profit thresholds to control your risk.

8. Open the Trade: Select “Trade” from the menu. Your transaction will need to be confirmed. Make sure you’re at ease with the limitations you’ve chosen.

9. Monitor Your deal: You may keep an eye on your deal in real-time after it has been opened. Tools & indicators are available on eToro for monitoring the performance of your investment.

10. Close Your deal: You may manually close your deal when you’re ready to. To prevent losses or ensure gains, you may also place automatic take-profit & stop-loss orders.

11. Withdraw cash: You may use the platform to submit a withdrawal request if you wish to take a withdrawal of your cash or earnings.

5 Tips For More Efficient Trading of Your Apple Stocks

Apple stock trading, or stock trading in general, involves a mix of strategy, discipline, & market knowledge. Here are five quick suggestions to improve your trading of Apple stocks:

1. Stay Informed: Pay careful attention to news, product announcements, & financial information about Apple. Gain a thorough grasp of the business’s foundations & the larger IT sector. Making intelligent trading choices may be aided by timely information.

2. Use Stop-Loss & Take-Profit Orders: When starting a trade, clearly define your stop-loss & take-profit orders. This assists in reducing possible losses & automatically locking in earnings. Avoid letting emotions influence your trading choices.

3. Diversify Your Portfolio: Refrain from investing all of your money in one stock, especially if it belongs to a powerful firm like Apple. By distributing your investments across many assets, industries, & sectors, diversification lowers risk.

4. Technical Analysis: Acquire & use fundamental methods of technical analysis. Technical indicators, chart patterns, & support & resistance levels may all provide light on probable price changes. It may be effective to combine technical analysis with fundamental analysis.

5. Manage Your Risk: Only put money into investments that you can afford to lose. Establish the percentage of your portfolio that you are prepared to put at risk for a single deal. Generally, it’s advised to put no more than 1% to 2% of your trading money at risk in a single transaction. This helps protect your whole portfolio from big losses.

Conclusion

In conclusion, Apple’s stock price on eToro depicts an active & constantly changing market for investors. The fundamental elements of trading AAPL shares have been covered, from market trends to risk management.

It’s important to keep in mind that the stock market is a place of risk & opportunity where careful study, a well-defined trading plan, & a dedication to remaining educated may make a world of difference.

Keep in mind that education & experience are your best friends as you pursue your trading endeavors. To fully use the potential of Apple stock & the wider financial world, continue your research, continue your education, &, most importantly, make wise judgements. Cheers to trading!