Air quality is a crucial environmental factor that directly impacts human health and well-being. The quality of the air we breathe can have significant implications for various aspects of our lives, including our respiratory health, allergies, and overall quality of life. In recent years, the insurance sector has recognized the importance of air quality data, historical weather data, and wildfire data in assessing risks and predicting claims and losses. By leveraging historical air quality data, weather data, and advanced analytics, insurers can gain valuable insights to enhance their underwriting processes, assess policy risks accurately, and develop proactive strategies to mitigate potential losses.

The Significance of Air Quality Data

Air quality data refers to the measurements and observations of pollutants and other relevant parameters in the atmosphere. With the advent of advanced monitoring technologies and the availability of vast amounts of data, insurers can access detailed information on air quality levels in specific regions and at different time intervals. This data is crucial for insurers to assess the potential risks associated with various policyholders and the areas they inhabit.

Air quality data provides insurers with a comprehensive understanding of the environmental conditions that policyholders are exposed to. By analyzing air quality data, insurers can identify areas with higher pollution levels and anticipate the potential health risks or property damage that policyholders may face. This knowledge allows insurers to tailor their policies and pricing accordingly, ensuring that policyholders are adequately covered while also managing their own risks.

Historical Air Quality Data and Its Role

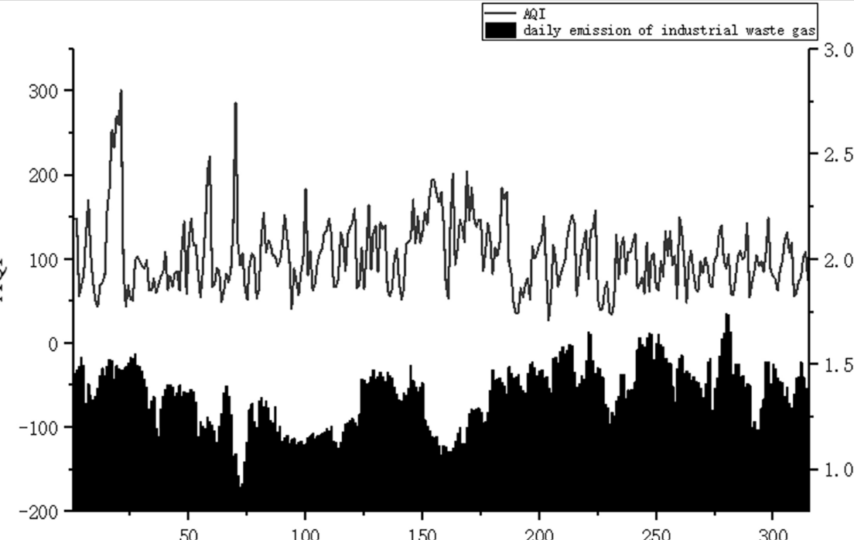

Historical air quality data plays a vital role in predicting claims and losses for insurers. By examining data collected over a significant period, insurers can identify patterns, trends, and correlations between air quality levels and insurance claims. This historical perspective allows insurers to make informed decisions based on past experiences and observations.

Analyzing historical air quality data enables insurers to uncover relationships between air pollution and specific health conditions or property damage. For example, a study conducted by XYZ Insurance Company analyzed historical air quality data in a particular region. The study revealed a correlation between high levels of air pollution and an increased number of respiratory-related claims during certain months of the year. Armed with this knowledge, the insurer adjusted their policies accordingly, resulting in better risk assessment and lower claim ratios.

Historical Weather Data and Its Role

Historical weather data, including information on temperature, humidity, wind patterns, and precipitation, also plays a crucial role in predicting claims and losses for insurers. By examining data collected over a significant period, insurers can identify patterns, trends, and correlations between weather conditions and insurance claims. This historical perspective allows insurers to make informed decisions based on past experiences and observations.

Analyzing historical weather data enables insurers to uncover relationships between specific weather conditions and their impact on health conditions or property damage. For example, a study conducted by XYZ Insurance Company analyzed historical weather data in a particular region and found a correlation between extreme weather events, such as wildfires or hurricanes, and an increased number of property damage claims. Armed with this knowledge, the insurer adjusted their policies accordingly, resulting in better risk assessment and lower claim ratios.

Predictive Analytics and Machine Learning

To leverage the full potential of air quality data, historical weather data, and wildfire data, insurers are turning to predictive analytics and machine learning algorithms. These technologies can analyze vast amounts of data and identify patterns, trends, and risk factors. By applying these techniques to historical air quality data, weather data, and wildfire data, insurers can develop models that predict the likelihood of claims and losses based on prevailing air quality, weather, and wildfire conditions.

Predictive analytics and machine learning models take into account various factors, such as pollutant levels, weather patterns, wildfire occurrence, population density, and previous claim history. By incorporating air quality data, historical weather data, and wildfire data into these models, insurers can gain a deeper understanding of the relationship between air pollution, weather events, wildfires, and insurance risks. This allows insurers to make more accurate risk assessments, determine appropriate premiums, and design policies that align with the specific needs and risks of policyholders.

For example, an insurance company specializing in property insurance uses predictive analytics to assess the risk of policyholders’ properties being affected by wildfires. By integrating historical weather data, wildfire data, and property information, the company can identify high-risk properties and offer tailored policies or recommendations for fire-resistant measures. This approach not only benefits policyholders but also enables insurers to manage their claim costs effectively.

Proactive Risk Mitigation

In addition to predicting claims and losses, air quality data, historical weather data, and wildfire data can empower insurers to take proactive measures to mitigate risks. By identifying regions with consistently poor air quality, areas prone to specific weather events or wildfires, insurers can partner with policyholders to implement preventive measures. This proactive approach not only reduces the likelihood of claims but also fosters a collaborative relationship between insurers and policyholders.

Insurers can offer incentives or discounts for policyholders to install air purifiers, implement fire-resistant measures, or take other actions that improve air quality and mitigate wildfire risks. By promoting awareness campaigns about the importance of air quality, weather preparedness, and wildfire prevention, insurers can educate policyholders about the potential risks and encourage them to take preventive measures. Additionally, insurers can provide information about areas with better air quality, lower weather-related risks, or wildfire-prone regions, allowing policyholders to make informed decisions about where to live or relocate.

The Role of Technology and Data Integration

Advancements in technology have revolutionized data collection and integration processes. The availability of real-time air quality monitoring devices, weather monitoring systems, and wildfire tracking platforms enables insurers to access up-to-date information and integrate it into their risk assessment systems seamlessly. By leveraging these technologies, insurers can improve their underwriting processes, monitor policyholder risks in real-time, and promptly address potential claims.

For instance, XYZ Insurance Company partners with Ambee, a leading environmental intelligence platform, to access accurate and reliable air quality data, historical weather data, and wildfire data. The integration of Ambee’s API allows XYZ Insurance to obtain real-time air quality data, weather updates, and wildfire information. This integration enhances their ability to predict claims, adjust premiums based on prevailing conditions, and provide proactive risk mitigation recommendations to policyholders.

Conclusion

Air quality data, historical weather data, and wildfire data have emerged as crucial factors for insurers in predicting claims and losses accurately. By leveraging historical data, advanced analytics, predictive modeling, and proactive risk mitigation strategies, insurers can make informed decisions, enhance risk assessment, and protect policyholders’ interests. The integration of technology, real-time data platforms, and partnerships with data providers enable insurers to stay ahead in the dynamic insurance landscape, enhance customer experience, and contribute to healthier, safer communities.