Cash App’s Direct Deposit feature makes it easy and fine for customers to get hold of their revenue or benefits. Notwithstanding, there would possibly be some safety issues using this factor. Also potential risks associated with it. We’ll go over the possible advantages & drawbacks of using the application. Show you the appropriate way of using it safely & effectively in this article. We’ve let you know more about the Cash App Bank Name application’s unique features. That may bring notable changes in your lifestyle.

Make fast & easy payments and direct deposits with Cash App

Image credit – topmostblog.com

The Cash app is the unique application where it is mainly concerned with cellular transactions. That makes it simple and speedy for customers to transfer and obtain money. Square Inc. Provides several economic offerings. It was an owned & run commercial enterprise when it first launched. It was referred to as Square Cash. modified its name.

On Android & iOS devices, it is freely available to simplify individual economic transactions. The app lets customers join a bank accor credit/debit card & they get a special $Cashtag username. For making repayments without having to inform anybody about their financial institution accounts.

Due to its comfort & ease, it has emerged as a popular preference amongst millennials. Because customers are able to add their cards & get payments done. The platform is especially beneficial to people who do not have any memberships with other financial institutions. Users can also find cashbacks cuz they provide money rewards for particular purchases.

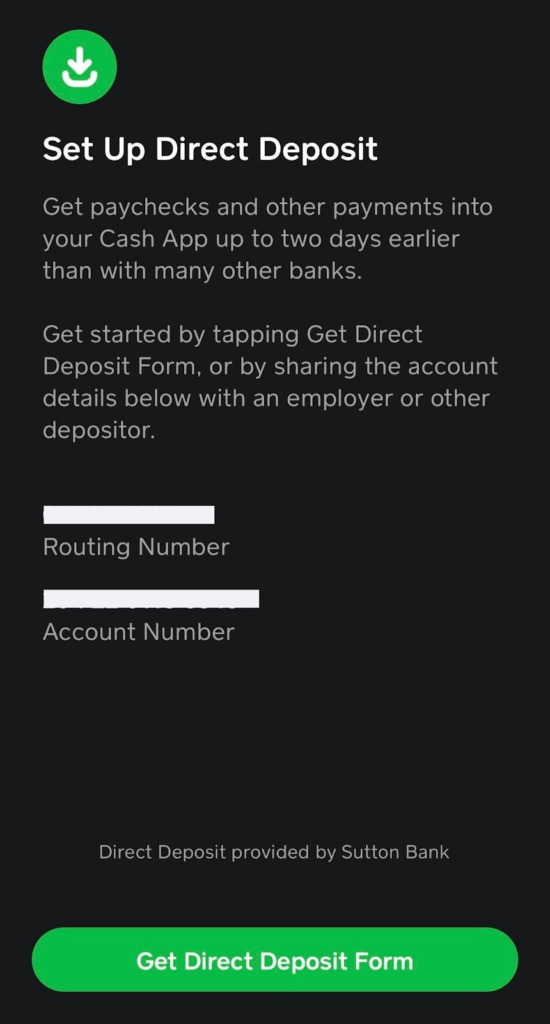

How to receive and setup the direct deposits on cash app

Image credit – Reddit

The method of doing a direct deposit within the application’s acc is quick & simple & it only requires a simple process:

- On a mobile device, log in to the personal cash account.

- At the lower left corner of the screen, choose the “Banking” icon.

- Choose the “Store” preference & tap on the option appeared to get the record code.

- Please examine the terms & conditions & accept them.

- The display will show your routing code, Cash App Bank Name & acc num. In order to obtain the amount you may additionally share this data with others to receive them.

- Always remember that the deposit would no longer become active for up to 2 paying periods.

What details are required for direct deposits in Cash App?

These are the information like Cash App Bank Name and Address that you require for the Direct Deposit form:

- Bank Name: Lincoln Savings Bank

- Bank Address: your address

- Routing Number : your routing number

- Account Number: your Cash App account number

- Account Type: Checking

What banks work with Cash App?

It works with two banks with Sutton & Lincoln savings banks being the Cash App Bank names.

Sutton Bank

Image credit – Galileo financial technologies

Founded in 1878, Sutton Bank is a medium-sized full-service bank from Attica, Ohio. It has several physical brick-and-mortar locations but is also available online or via a mobile app.

The bank has products such as savings and checking accounts, money market accounts, credit cards, IRAs, CDs and mortgages.

Lincoln Savings Bank

Image credit – Lincoln savings bank

Lincoln Savings Bank, not to be confused with Lincoln Savings and Loan Association, of Cedar Falls, Iowa. It was founded in 1902 and now has a total value of $1 billion and $875 million in foreign investments.

A full-service bank that offers deposit accounts, and loans. Also other traditional services in brick-and-mortar locations, as well as in its online mobile application.

The bank also has a banking partner that manages the direct deposit service. Which is an important part of the treasury program. Without a bank partner, there will be no cashier program due to the lack of a bank license.

Make your life even more is with Cash App Card

Image credit – wikiHow

Getting a cash application card is certainly a clear cycle. However, there are a wide variety of approaches to reduce costs.

The steps to getting a cash software card are as follows:

- Make sure your mobile gadget has the Cash or Google Play Store app installed.

- If you have not already, open an account with the cash program. You have to provide person data, for example, your name, date of birth and authorities-backed retirement number.

- Connect your cash account to a legitimate debit card.

- You can use the app to request a Cashback card after linking your debit card. Although the cards come pre-paid, delivery normally charges around $5.

- After you place your order, the Cash card will be dispatched by mail within 7 to 10 working days.

Activation & complete setup process of Cash App Card

The method of activating the Cash card is easy & possible to accomplish in simple & convenient steps:

- On a cellular device, log in to the personal cash account.

- At the display’s bottom, locate the “Cash Card” section by scrolling down.

- To access the Cash card’s information, choose the image.

- The green “Activate Cash Card” button appeared there.

- Scan the QR code card with the digicam on your device. Alternatively, one can manually type the CVV code if your device no longer has a camera.

- Your card will be activated after you scan the QR code or enter the CVV code.

- After that, you can customize your card. By including a title or initials, selecting a shade or design, and adding a one-of-a-kind signature.

Why should you prefer a Cash App?

There exists a number of reasons why it is so popular for mobiles:

Easy in using: It consists of a primary and instinctive factor of interaction. That permits consumers to send & get

amounts without any problem.

Transaction Speed: The client normally gets the cash after the transaction has completed & app transactions are quick.

Secure: Encryption and two-factor authentication are two of the several safety measures. That the Cash app employs to guard the monetary and private records of its users.

No Cost: It is free to download and use to transfer & obtain amounts from different customers.

Bank Transfer: Customers can use the direct deposit service. It permits them to acquire advantages and salaries into their account immediately.

Cash Card: That lets customers make purchases and withdraw money from the ATMs, is accessible to customers.

Bitcoin Assistance: Users can purchase and promote Bitcoin & make cryptocurrency investing simple.

Conclusion

In conclusion, the direct deposit function of Cash App has made it easy and speedy for customers. To acquire amounts or advantages without actually going to the financial institutions. We need minimum requirements like Cash App bank name and Address for direct deposits. The cash app bank name where the cash app works with. Even though it is for free, it is necessary to prioritize protecting economic & private info. Late processing or fraud are two potential troubles with Cash App direct deposit. Although we can minimize these risks by keeping an eye on the transactions & following acc safety fine practices.