Introduction:

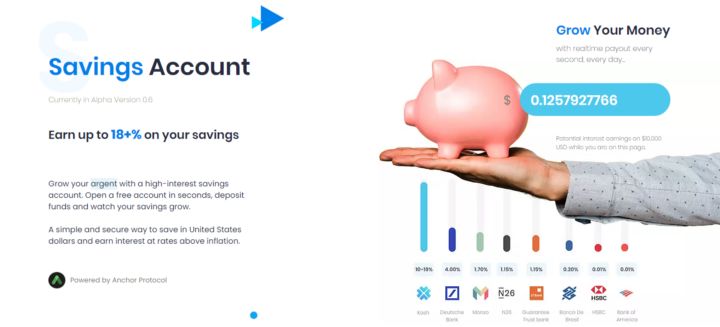

You generally earn a few hobbies at the account balance when you’ve got cash tucked away in a financial savings account. Unfortunately, the hobby you earn won’t generate a good deal of income.

That’s mainly an authentic kash saving account through a recession, like now. At the same time, the U.S. imperative financial institution lowers fees to inspire greater spending and decrease the price of borrowing cash.

In a few cases, you’ll land up incomes much less than the fee of inflation; this means that the cash you’ve stored is dropping spending strength over time. But there are approaches to earn extra in your cash. So, when you have a little cash set apart and need to earn a better hobby fee without taking excessive risk, don’t forget those strategies.

Take advantage of bank bonuses.

Many banks provide introductory bonuses for brand spanking new clients who join up for an account and meet some requirements. Usually, bank account bonuses require which you installation everyday direct deposits and make a minimal kash saving account variety of transactions every assertion duration.

For humans with a few financial savings already set aside, financial savings account bonuses may be a smooth manner to grow your earnings. These bonuses normally ask new clients to switch a minimal quantity to the account and maintain it there for a duration of time. In short, you can enhance the stability of your financial savings by establishing a brand new account and investing it with financial savings held at some other bank.

For example, you may see an advantage offering $four hundred if you transfer $10,000 and preserve that stability within the account for a minimum of 3 months. Then, you can calculate the powerful hobby price for the provider is quite quickly.

If you earn $four hundred on the stability of $10,000 in 3 months, you’ll earn the equal of a sixteen percentage annual go back in that preliminary 3-month bonus period. As an advantage, you’ll additionally get the account’s regular Kash saving account annual hobby bills while you’ve got your financial savings withinside the account, boosting your income further.

If you pass this route, be cautious to study all of the great print. Some banks will rate a charge if you don’t meet sure necessities or attempt to near the account too quickly after beginning it. Some banks may even make you forfeit the praise if you near the account quickly once you have the bonus.

Consider the certificates of deposits.

Certificates of deposit (CDs) provide better hobby fees than conventional financial savings debts in change for decreased Kash saving account for withdrawal flexibility. When you place cash in a CD, you need to agree to depart the cash within the account for a fixed time, known as the period.

For example, if you open a one-year CD, you need to go away the cash within the account for a complete year. If you withdraw your deposit earlier than the period expires, you’ll pay an early withdrawal penalty.

One advantage of CDs is which you lock it withinside the hobby charge while you open the CD. Thus, even if marketplace fees drop, you’ll maintain incomes at an equal charge. But, conversely, if fees rise, you’ll be caught incomes the decrease charge until the CD matures.

Conclusion:

Once the CD period ends, you may withdraw your cash or roll it into a brand new CD. If you roll the stability into a brand new CD, you need to watch for that CD to mature earlier than having any other danger to make a penalty-unfastened withdrawal.

Read More : How to get protection on inflation with Kash stablecoins?