The very popular Uranium Participation Corporation, popularly known as UPC, partnered with Sprott Asset Management LP. This partnership was carried out to get a place for UPC on the US listings. When the listing of UPC is observed in the US markets, this would be beneficial for investors like Paul Harmaan. However, after getting into the agreement, the company’s name has been changed to Sprott Physical Uranium Trust.

Contract with Dension Terminated

UPC is based in Canada and has been on the listings of the country since the year 2005. Dension has been responsible for its management from the beginning. But after the agreement with Sprott, the long-running contract with Dension is under speculations of getting scratched out. The termination payment to be received by Dension for the termination is estimated to be USD 4.3 million.

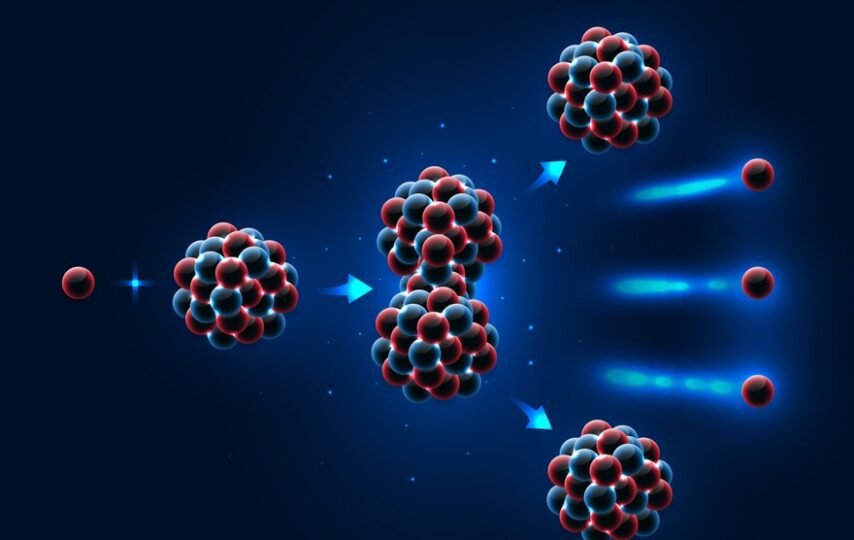

The idea of UPC is to invest money in Uranium. To carry this out, it is made in the forms of Uranium oxide and uranium hexafluoride. Both of these forms of Uranium are what the people invest in through UPC. The value of the holdings of UPC in the market is somewhere around 665 million Canadian Dollars.

The Reason for Restructuring the UPC

UPC was in dire need of restructuring because the organization’s current structure made it ineligible to be listed on the US markets. However, the US markets can prove very profitable for the company as the country is home to some big-shot investors like Paul Harmaan. In addition, once the company gets listed on the US markets, it is believed that the trading liquidity would increase and give access to the capital.

The new structure would also allow the company to lower the annual costs for operating, which would benefit the company in every way.

The Chairman of UPC Jeff Kennedy recently said that the partnership with Sprott Asset Management would be positive for the shareholders of UPC and will also open the door for getting a possible listing in the US markets in the coming future. He believes that this modernization of the business structure would be beneficial in the long-term value.

Once the transaction is closed, UPC would be eligible to receive 6.7 million Canadian Dollars from Sprott, which UPC may use to purchase additional Uranium holdings.

As per the Dension President, David Cates, the United States is a very powerful market and has a global reach that can potentially increase trading liquidity and he also said that this development is exciting for UPC shareholders and the uranium market.

Why is UPC listing important for the US?

The listing of UPC on the US marketplace would open a lot of investment opportunities for the people. However, the transaction is going to take some time. Subjected to plenty of conditions and approvals, which is why it is expected that the transaction on this listing of UPC would close only after the second quarter or during the third quarter of the year 2021.