Forex is an abbreviation for foreign exchange, exchanging one currency for another. This process can be done for many reasons, such as business, tourism, and to make international trade possible.

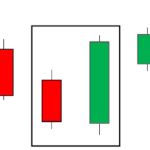

While much currency exchange is done for practical reasons, most currency conversion is undertaken to generate profits. Due to the amount of money converted every day, the prices of some currencies can be very volatile. This volatility, which increases the danger and the potential for huge returns, makes it alluring to traders. We found a good source for learning about market open times: https://tradenation.com/articles/what-time-does-forex-market-open

But what surprises a lot of investors is knowing that the currency market is the largest financial market. According to an FX and OTC derivatives market survey, the average daily traded volume is USD 6.6 trillion. Additionally, about USD 1.1 trillion in trades happens daily on the New York Stock Exchange.

Let us understand forex trading more in-depth:

What is it?

Forex trading is like exchanging money when you travel abroad: A trader buys one currency and sells another, and the exchange rate changes all the time depending on how much each currency is bought and sold. Financial institutions, businesses, investment companies, hedge funds, and individual traders all trade on the forex market. A network of banks or other financial institutions runs the currency market.

For example, the exchange rate between the euro and the US dollar is 2 to 1. Buying 1,000 euros would cost you USD 2,000 in US dollars. If the exchange rate changes in the future, you could sell these euros for USD 2,500, making a profit of USD 500. Forex gets traded on the currency market, open 24 hours a day, five days a week, for buying and selling currencies. So, people who trade Forex do not do it during specific times of the day.

It also means that business is always going on somewhere in the world, so currencies are always moving. For instance, the US dollar changes the most during the daytime in the US, whereas the euro will change the most when its day in Europe. All forex trading is done over the counter (OTC), which means there are no physical exchanges like there are for stocks.

Investors can trade in the foreign exchange market from anywhere worldwide using an online trading platform, such as ICICIdirect. Most forex trading happens between institutional traders, such as those employed by banks, fund managers, and multinational organisations. These traders may only speculate on, or hedge against potential currency exchange rate swings and may not be planning to take physical ownership of the currencies themselves.

Conclusion

The foreign exchange market gives traders numerous chances to make money. They have access to leverage, can trade around the clock, and can start small. They have such options because there are a lot of online brokers. But remember that while there is a high chance of making money off currency trading, there are also risks. Using leverage can lead to massive losses, and people who want to trade should compete with traders who work for financial institutions.